Ind AS 8 "Accounting Policies, Changes in Accounting Estimates and Errors" is intended to enhance the relevance and reliability of an entity’s financial statements, and also to make financial statements comparable over time along with the financial statements of other entities.

What are the objectives of implementing this Ind AS?

The objective of this Standard is to prescribe the criteria for selecting and changing accounting policies, together with the accounting treatment and disclosure of changes in accounting policies, changes in accounting estimates and corrections of errors.

Relevance of Ind AS - 8

This Standard shall be applied in

Now, let's dive into Ind AS 8:

Accounting Policies

These are specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial statements.

Example of accounting policies can be method of determination of cost of inventories (fifo/weighted average) or basis of measurement of non-current asset (cost or revaluation)

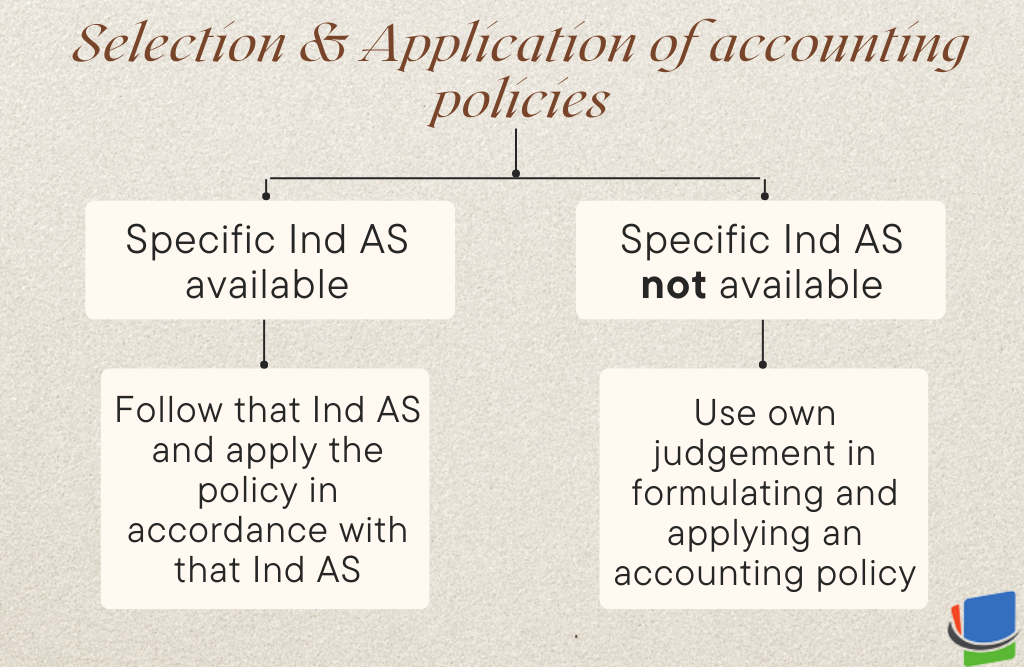

In making the judgement management shall refer to, and consider the applicability of, the following sources in descending order:

(a) Any other Ind ASs dealing with similar and related issues;

(b) the definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in the Framework;

(c) Pronouncements of International Accounting Standards Board (IASB);

(d) Pronouncements of other standard-setting bodies that use a similar conceptual framework;

(e) Other accounting literature and accepted industry practices.

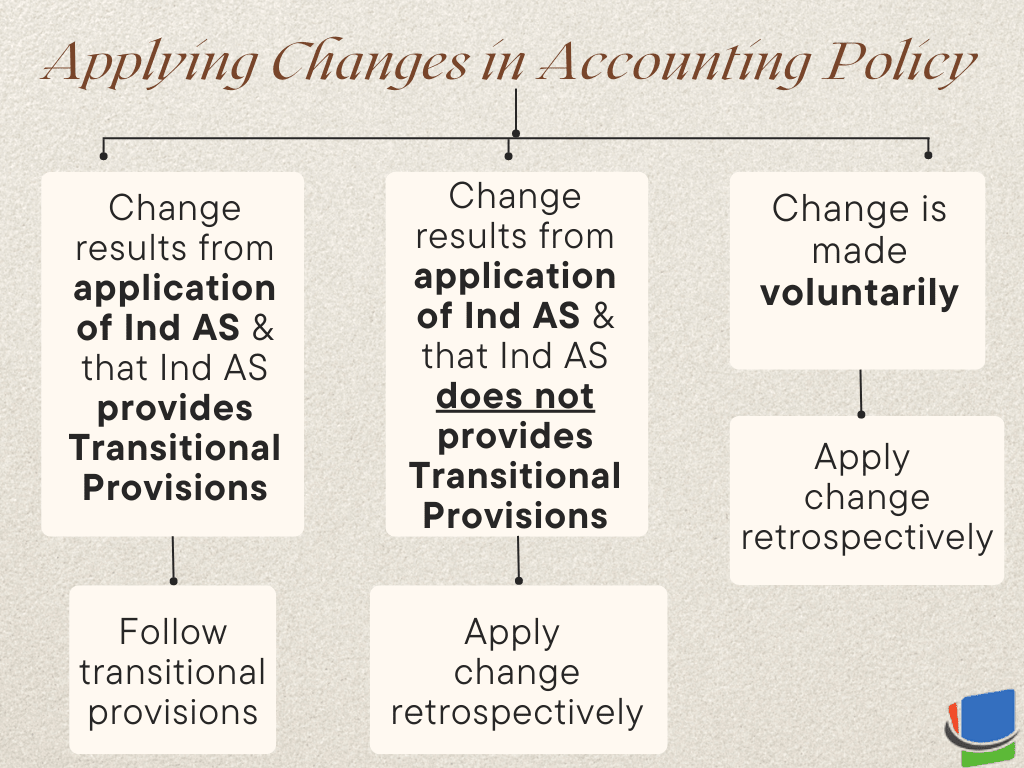

Organization should select and apply its accounting policies consistently for similar transactions, other events and conditions and it shall change accounting policy only if:

(a) It is required by an Ind AS or

(b) It results in the financial statements providing more reliable and relevant information.

The following are however not considered as changes in accounting policies:

(a) the application of an accounting policy for transactions that differ in substance from those previously occurring; and

(b) the application of a new accounting policy for transactions that did not occur previously or were immaterial.

Retrospective application means applying the accounting policy as if that policy had always been applied.

Now as you might remember from Ind AS 1 that "An entity shall present a third balance sheet as at the beginning of the preceding period in addition to the minimum comparative financial statements if there is any change in accounting policies that will have impact retrospectively".

This means that comparative information for all priors period presented will be adjusted for the effect of change in accounting policy.

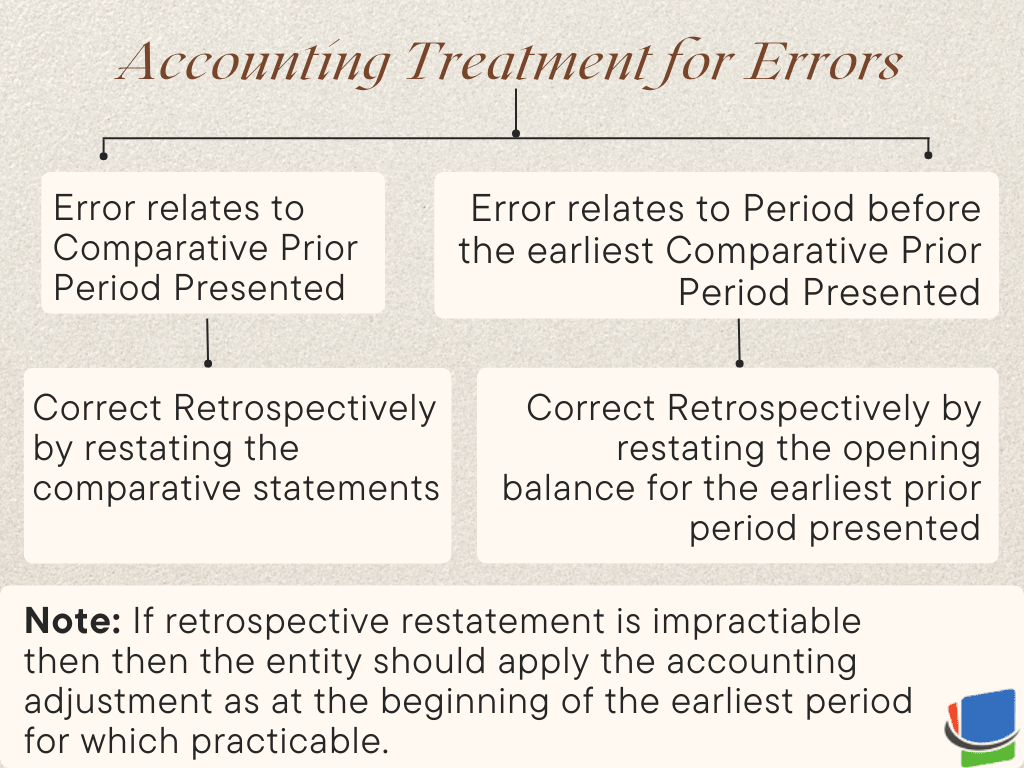

However, if it is impracticable to determine the effect of retrospective application in previous years then the entity should apply the accounting adjustment as at the beginning of the earliest period for which practicable.

Accounting Estimate

Accounting estimates can be said to be techniques or estimations that are used by management to ascertain figures where accurate values cannot be determined. Example : Bad Debts, Inventory Obsolescence, Method of Depreciation, etc.

Now, new information or development or more experience might result into change in accounting estimate. So, how to account for change in estimate?

Apply the change Prospectively i.e. apply the change from the date of the change in estimate.

The effect of change in an accounting estimate, which does not give rise to a change in assets and liabilities shall be recognised in P&L of that period only if change affects only that period and if change affects that period along with future period then it is be recognised in both periods.

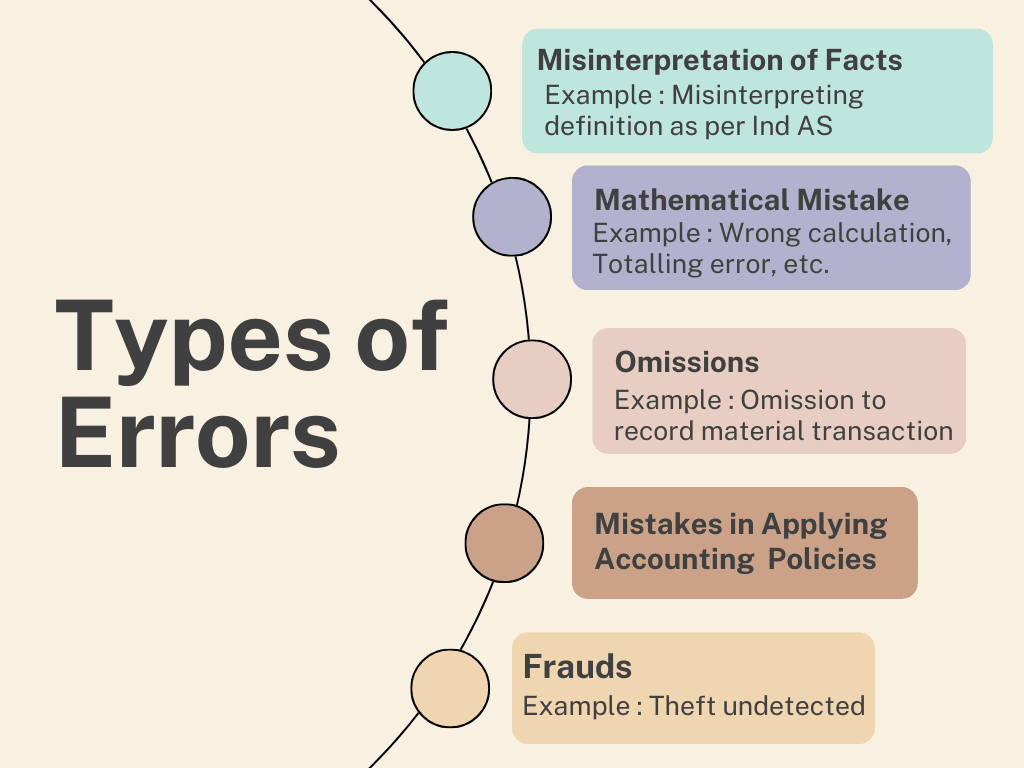

Errors

Errors can be defined as omissions and misstatements for one or more period arising from a failure to use or misuse of reliable information that