What are the objectives of implementing Ind AS 1?

Primarily this Ind AS objectifies the preparation and presentation of General purpose Financial Statement for profit oriented entities (Can also be applied by not-for -profit entities after certain amendments).

General purpose Financial Statements are issued by companies to facilitate the decision making of their stakeholders. It includes a balance sheet, income statement, statement of changes in equity, statement of cash flows & notes comprising significant policies and other explanatory information. Companies use these statements as a form of financial reporting to communicate company’s performance with the stakeholders of the organization.

This Ind AS mandates all companies to present the financial statements along with its comparison with financial statements of previous period and also specifies the structure of financial statements, Minimum information that has to be disclosed and the disclosures of relevant accounting policies.

Relevance of Ind AS 1

As the name suggests “Presentation of Financial Statements”, it gives out the guidance on how the ideal financial statements should look like, material items, for the general stakeholders, should be conveniently reachable and no ambiguity is caused while interpreting the financial statements.

What role Ind AS 1 play in accounting framework?

It prescribes the basis for presentation of financial statements to ensure comparability both with own financial statements of previous periods and with financial statements of other entities

Whereas all other Ind AS set out recognition, measurement and disclosure requirement of specific transactions and events.

It also describes the general features every financial statement shall consist-

*Crux of Para 15-35 of bare act

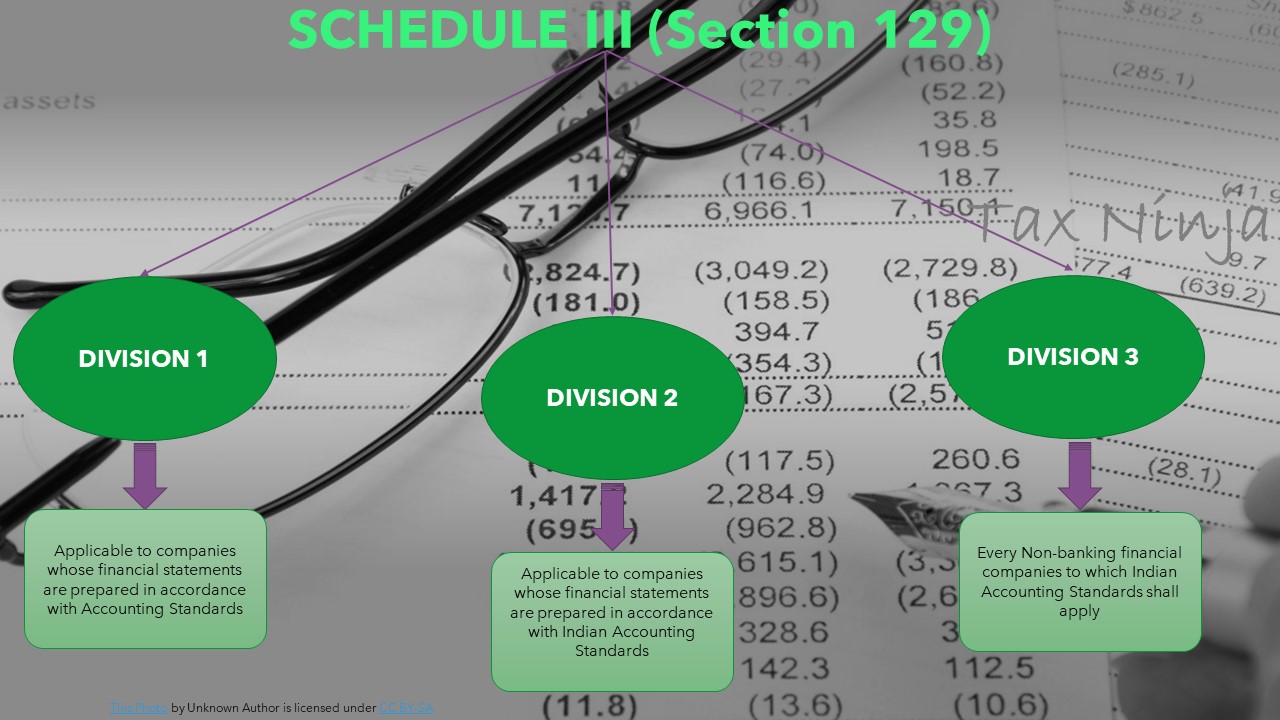

However, the format is not provided under the Ind AS (Schedule III has to be followed) but it has provided the list of minimum line items that has to be presented under each component of financial statements (Refer Key Paragraph section).

In case of dispute between Ind AS & Schedule III

General Instructions of Schedule III specified in 1st point - “Where compliance with the requirements of the Act including Accounting Standards as applicable to the companies require any change in treatment or disclosure including addition, amendment, substitution or deletion in the head or sub-head or any changes, inter se, in the financial statements or statements forming part thereof, the same shall be made and the requirements of this Schedule shall stand modified accordingly”.

After interpreting the above statement, it is very clear that in case of any dispute between the Ind AS and Schedule III, Ind AS shall prevail.

This statement can also confirmed by interpreting 2nd point - which clearly depicts that the requirements of Schedule III are in addition to that of requirements specified in accounting standards and not in substitution of the same.

What are the basic points that has to be kept in mind while implementing this Ind AS?

An entity shall present a third balance sheet as at the beginning of the preceding period in addition to the minimum comparative financial statements if:

This is the end of Part 1 of Ind AS 1, in next part we will cover the key paragraphs, paragraphs specifying disclosures and the carve outs to conclude our Ind AS 1. Adieu!