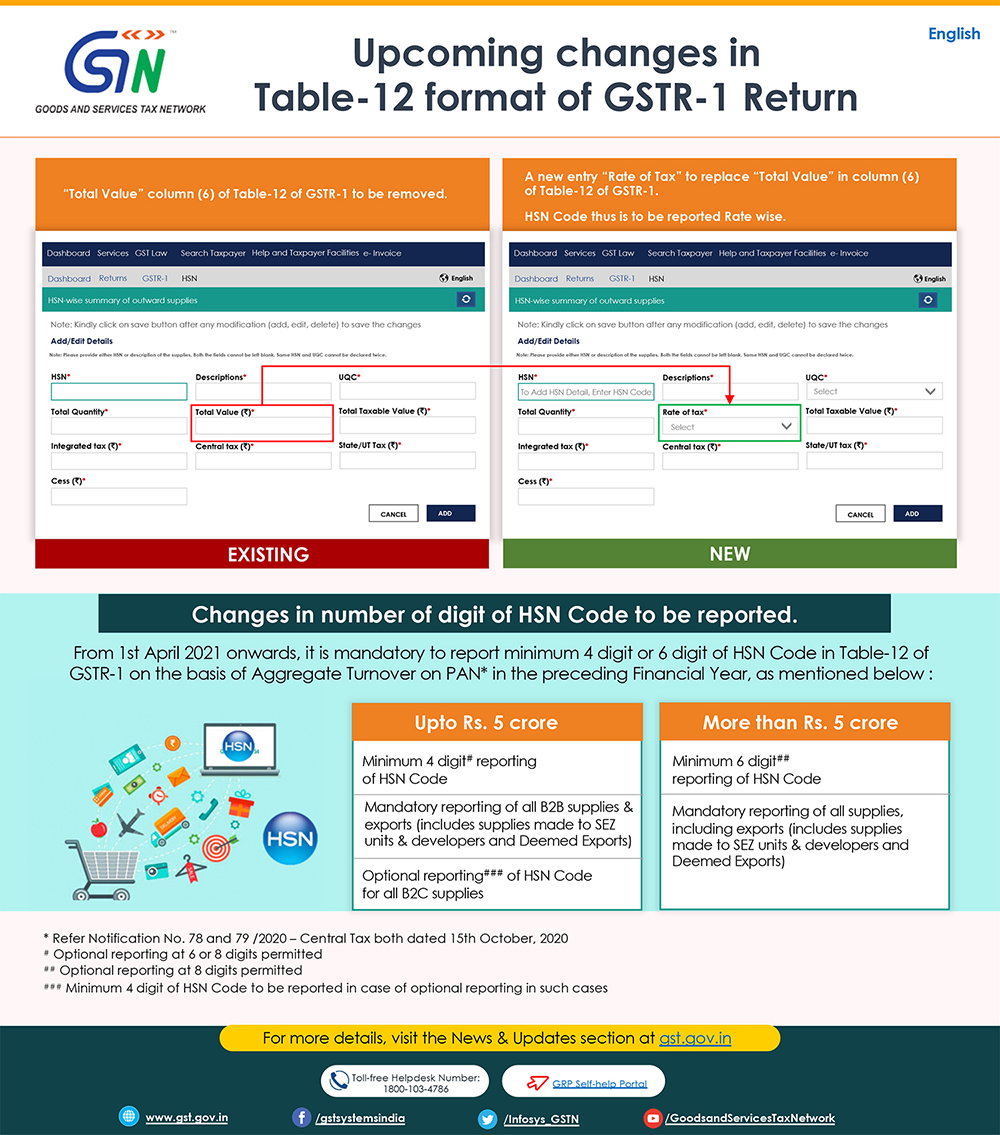

The GSTN (Goods and Service Tax Network) has informed the stakeholders in regards to the upcoming changes in Table-12 format of GSTR-1 Return.

The changes include changes in the format of GSTR-1 Return along with the changes in the number of digits of the HSN Code to be reported.

The CBIC vide Notification No. 78/2020 dated 15/10/2020 seeks to notify the number of HSN digits required on tax invoice with effect from the 01st day of April, 2021 on the basis of Aggregate Turnover on PAN in the preceding Financial Year, which are as follows:

S. No. Aggregate Turnover in the preceding Financial Year Number of Digits of Harmonised System of Nomenclature Code (HSN Code) 1 Up to rupees five crores 4 2 More than rupees five crores 6 It may be pertinent to note that a registered person having aggregate turnover up to five crores rupees in the previous financial year may not mention the number of digits of HSN Code, as specified in the corresponding entry in column (3) of the said Table in a tax invoice issued by him under the said rules in respect of supplies made to unregistered persons.

In accordance with the said provision, the GSTN has notified the changes in Table-12 format of GSTR-1 Return, which are as follows: