The Institute of Chartered Accountants of India (ICAI), in it's eight edition of Guidance Note on Tax Audit has clarified over the definition of turnover for option traders to determine applicability of tax audit u/s 44AB.

Now, before moving towards the clarification, let us first understand whether Income from Futures & Options is considered as Speculative Income or not.

So, let us refer to section 43(5) of Income-tax Act, 1961:

Speculative transaction means a transaction in which a contract for the purchase or sale of any commodity, including stocks and shares, is periodically or ultimately settled otherwise than by the actual delivery or transfer of the commodity or scrips.

Provided that for the purposes of this clause

...................................

(d) an eligible transaction in respect of trading in derivatives referred to in clause (ac) of section 2 of the Securities Contracts (Regulation) Act, 1956 (42 of 1956) carried out in a recognised stock exchange; or

(e) an eligible transaction in respect of trading in commodity derivatives carried out in a [recognised stock exchange], which is chargeable to commodities transaction tax under Chapter VII of the Finance Act, 2013 (17 of 2013),

shall not be deemed to be a speculative transaction.

Thus, we can now conclude that Income from Futures & Options are considered as Non-Speculative Income.

Now, let us move towards applicability of tax audit for Futures & Options :

If the turnover is upto Rs. 2 Crores: Tax Audit is applicable u/s 44AB(e)

- If the profit or loss is less than 6% of the turnover; AND

- total income is more than basic exemption limit; AND

- you have not opted out of the presumptive taxation scheme in any of the previous 5 financial years.

If the turnover is above Rs. 1 Crores but upto Rs. 10 Crores: Tax Audit is applicable u/s 44AB(a) if less than 95% of the total payments or less than 95% of the total receipts are digital in nature.

If the turnover is above Rs. 10 Crores: Tax Audit is applicable u/s 44AB(a) irrespective of profit or loss.

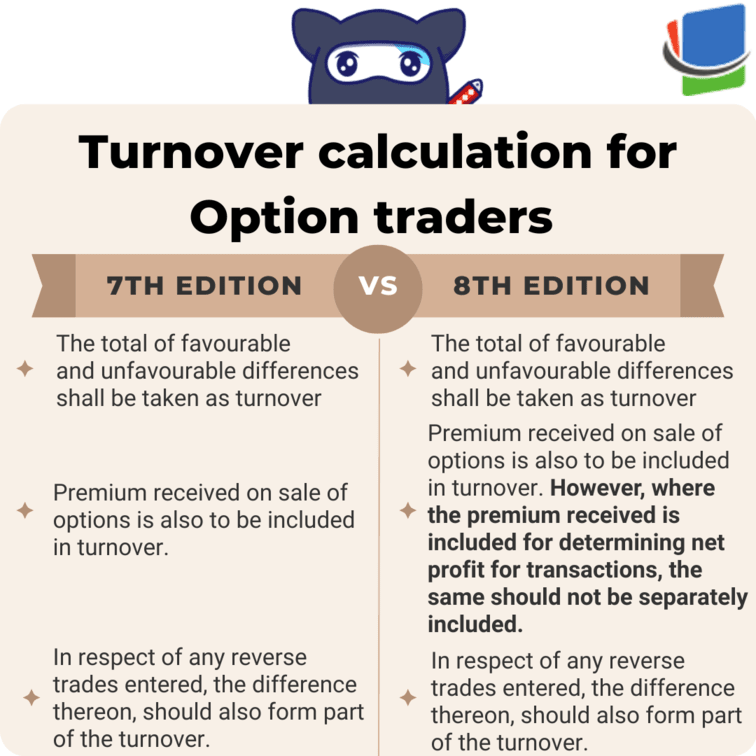

So, what has changed after the publication of eight edition of Guidance Note on Tax Audit?

As per 7th edition of the guidance note, premium received on sale of options is to be included in the calculation of turnover. And with the absence of any further information, profit along with premium received was included for the calculation of turnover.

However, 8th edition of the guidance note has made it absolute clear that if premium has already been included for the calculation of the net profit, the same should not be included separately.

In other words, we can say that:

Now, if you are still confused about the change, let's understand the change through an example:

So, the calculation for total turnover will be as follows:

| Script | Type | Lot Size | Buy Value | Sales Value | Gain / (Loss) | Turnover (As per 7th Edition) | Turnover (As per 8th Edition) |

| (A) | (B) | (C) | (D) | (E) | (F) | (G) = (E) + (F) | (H) = (E) - (D) |

| XYZ | Call Option | 400 | 40,000 | 80,000 | 40,000 | 1,20,000 | 40,000 |

| ABC | Put Option | 400 | 40,000 | 20,000 | (20,000) | 40,000 | 20,000 |

| PQR | Call Option (Not Squared Off) | 400 | - | 80,000 | - | 80,000 | 80,000 |

| Total | 2,40,000 | 1,40,000 | |||||

Thus, you can see that the turnover of these trades as per 7th edition of Guidance Note will be Rs. 2,40,000 while as per 8th edition of Guidance Note will be only Rs. 1,40,000.

This is definitely going to ease out the burden of compliances on the option traders and the new turnover calculation might not even mandate tax audit.