The introduction of Tax on LTCG (Long Term Capital Gain) of 10% over one lakh in Budget 2018 was a move which created a hindrance in journey of investment for investors. As now tax has to be paid on gain above Rs.1,00,000 which would reduce Effective rate of return for an investor.

And to avoid or save this tax the use of Tax Harvesting method started. Which works on Invest – Redeem – Reinvest formula and saves taxes using an exemption window of Rs 100,000. Before talking about how it actually works and its advantages and disadvantages, Lets first understood more about this exemption window

As Per sub-section 2 to section 112A of Income Tax act, the tax payable by the assessee on the total income referred to in sub-section (1), that include long term gain from shares, equity-oriented fund and business trust, shall be the amount of income-tax calculated on such long-term capital gains exceeding one lakh rupees at the rate of ten per cent.

Now one important thing is that exemption of 1,00,000 is Per year and cannot be rolled over which means if an investment is made for 9 years and LTCG arise in end of 9 years the exemption of 1,00,000 can be used not total of 9,00,000. In concept of Tax harvesting, we use these unutilized limits of 1,00,000 every year during the investment and make a tax saving of 100,000 x 10% = 10,000 every year.

Sounds interesting let’s check it out how it’s possible

What is tax-harvesting?

Tax harvesting is about splitting your gain between the intermediate years and using the tax shield of Rs 1,00,000 by making gain realise earlier than maturity.

Let’s understand with an example

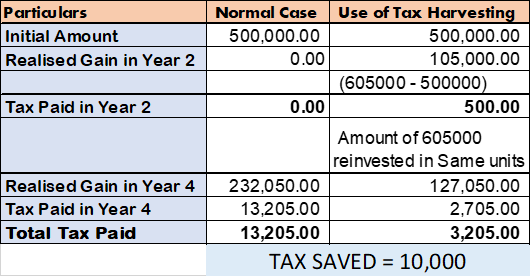

You invested in Mutual fund Rs. 5,00,000 which will grow at a constant rate of 10% for 4 Years.

The amount at respective years will be as follow-

| Year | 0 | 1 | 2 | 3 | 4 |

| Amount | 5,00,000.00 | 5,50,000.00 | 6,05,000.00 | 6,65,500.00 | 7,32,050.00 |

The total gain will be Rs 732,050 – 500,000 = Rs 232,050

Let’s compare now Two scenarios Normal Case and one using Tax Harvesting

In Tax Harvesting Case we will try to split our gain in two years so that we can reduce our tax liability, for that we will sell our investment in Year 2 and will do reinvest in same units at same time.

Few Disadvantages

It is important to note that all the above discussions are made in respect of Long-term Capital gain i.e., investments are hold for more than 12 months.

Raise your thoughts or queries in comment box or can even connect us at [email protected].