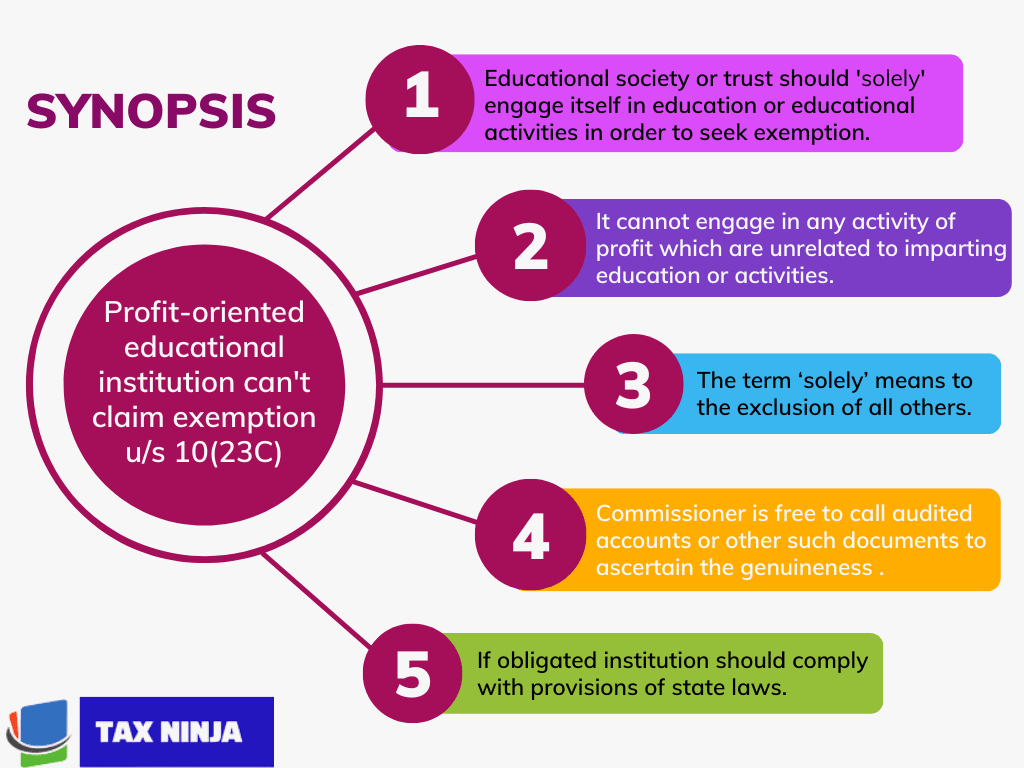

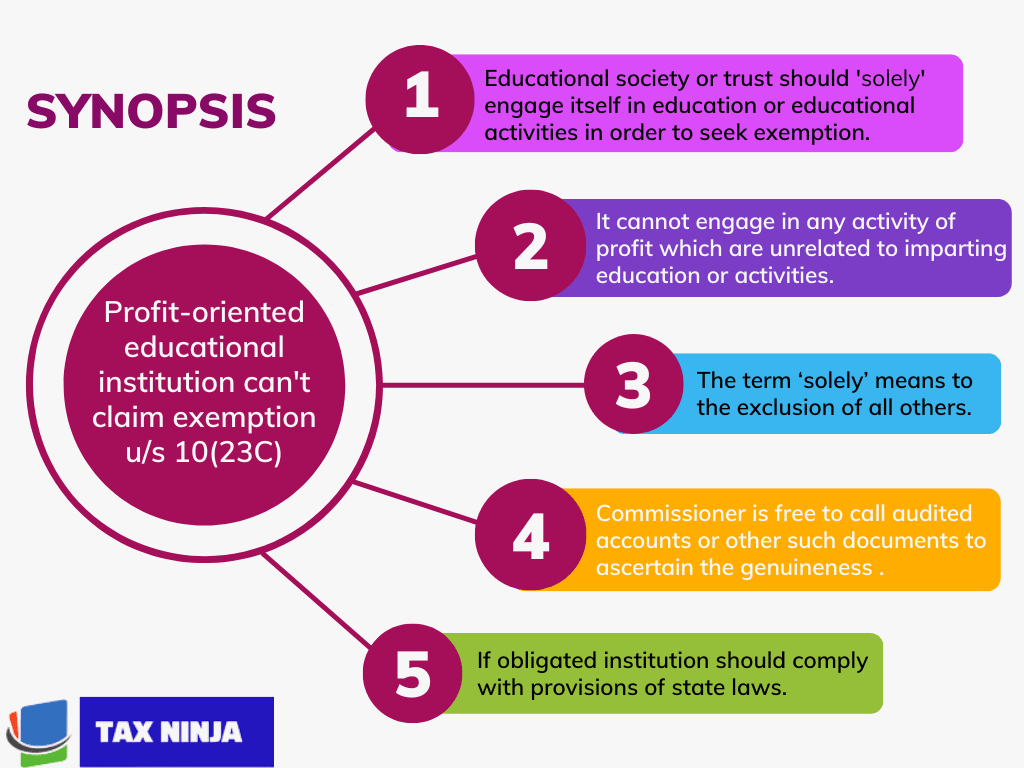

The Hon'ble Supreme Court in the case of New Noble Educational Society vs CIT has held that the educational society or trust should 'solely' engage itself in education or educational activities in order to seek exemption under section 10(23C) of the Income-tax Act,1961. It cannot engage in any activity of profit i.e. that such institutions cannot have objects which are unrelated to imparting education or or be with educational activities.

The Apex court has held that the term 'solely' is not the same as 'predominant / mainly', it means 'to the exclusion of all others'.

Facts of the Case :

- New Noble Educational Society (appellant) has applied for the registration of trust set up for the charitable purpose of education, under the Income-tax Act, 1961.

- Appellant were denied registration on the ground that they were not registered under the Andhra Pradesh Charitable and Hindu Religious Institutions and Endowments Act, 1987 as condition precedent for grant of approval.

- The Andhra Pradesh High Court also held that the appellant trusts which claimed benefit of exemption under Section 10 (23C) of the IT Act were not created ‘solely’ for the purpose of education which was determined after considering the memorandum of association.

Questions framed for adjudication :

- Whether the objects in the memorandum of association of a society/trust are conclusive proof of such a trust existing solely as an educational institution entitled for the benefits, and being eligible for approval, under section 10(23C)(vi) of the Act?

- Whether registration, under the Andhra Pradesh Charitable and Hindu Religious Institutions and Endowments Act, 1987, is a prerequisite for seeking approval under the Income-tax Act, 1961?

Argument by the Appellant :

- Precondition for grant of approval was absent in the provisos to Section 10(23C)(vi) of the IT Act and that since the tax statute was a complete code in itself, other acts such as Andhra Pradesh Charitable and Hindu Religious Institutions and Endowments Act, 1987 could not form the basis for denying approval.

- It was urged that there was no bar or restriction imposed by law on trusts involved or engaged in activities other than education, from claiming exemption under Section 10(23C)(vi), provided their motive was not-for-profit.

- Appellant relied on the decision of this court in American Hotel and Lodging Association v Central Board of Direct Taxes and Queen’s Education Society v Commissioner of Income Tax to submit that the test for determination was whether the ‘principal’ or ‘main’ activity was education or not, rather than whether some profits were incidentally earned.

- Appelant also relied on the decision of Oxford University Press v. CIT , where interpretation of the expression ‘solely’ for the purpose of education meant that the sole purpose of an institution must be to impart education and not make profit.

Supreme Court held :

- The term ‘any university or other educational institution existing solely for educational purposes and not for purposes of profit’ in the seventh proviso to Section 10(23C) relates to the profits of a business which is ‘incidental’ to the educational activity which can be say sale of textbooks/uniform, hostel facilities, etc.

- The expression ‘solely’ has been interpreted, as noticed previously, by other judgments as the ‘dominant / predominant /primary/ main’ object. The plain and grammatical meaning of the term ‘sole’ or ‘solely’ however, is ‘only’ or ‘exclusively’.The Cambridge Dictionary defines ‘solely’ to be, “Only and not involving anyone or anything else”. It is, therefore, clear that term ‘solely’ is not the same as ‘predominant / mainly’. The term ‘solely’ means to the exclusion of all others.

- The decisions in American Hotel or Queens Education Society did not explore the true meaning of the expression ‘solely’ in the context of educational institutions.

- The trust or educational institution, which seeks approval or exemption, should solely be concerned with education, or education related activities. If, incidentally, while carrying on those objectives, the trust earns profits, it has to maintain separate books of account.

- While considering applications for approval under Section 10(23C), the Commissioner is not bound to examine only the objects of the institution. To ascertain the genuineness of the institution and the manner of its functioning, the Commissioner is free to call for the audited accounts or other such documents for recording satisfaction where the society, trust or institution genuinely seeks to achieve the objects which it professes.

- Wherever registration of trust or charities is obligatory under state or local laws, the concerned trust, society, other institution etc. seeking approval under Section 10(23C) should also comply with provisions of such state laws. This would enable the Commissioner or concerned authority to ascertain the genuineness of the trust, society etc.

Thus, the appeal filed by appellant is dismissed.