The Goods and Service Tax Network (GSTN) has enabled the new feature to select Core Business Activity enabled on GST Portal.

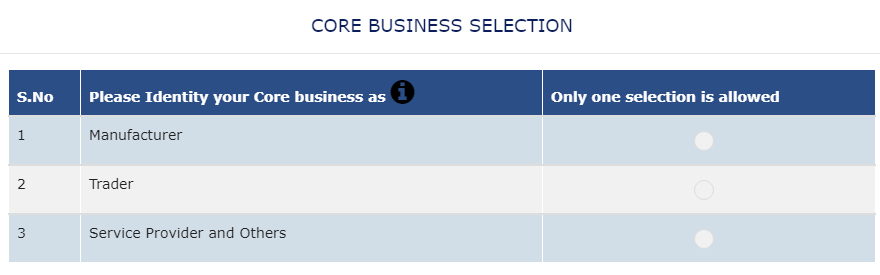

You might have noticed that a popup (as depicted below) shows up after logging under the GST Portal which mandates core business activities to be selected to proceed further.

Accordingly, we have prepared the FAQ's in relation to the same:

(i) Manufacturer

(ii) Trader

(iii) Service Provider and Others

| MANUFACTURER |

A manufacturer is a registered person produces new products from raw materials and components using tools, equipment’s and machines and then sells them to the consumers, wholesalers, distributors, retailers or to the other manufacturers. A manufacturer may sell some more brought out items or may provide some ancillary services with his manufactured goods, but he would continue to be classified as manufacturer because it is the Primary Business Activity. |

| TRADER |

A trader is a registered person who engages in the buying and selling of goods. Traders have been further classified as - • Wholesaler or Distributor • Retailer Retailer includes a registered person selling goods through e-commerce operators. |

| SERVICE PROVIDER AND OTHERS |

A service provider is a registered person who provides service to a recipient of service and is neither a manufacturer nor a trader. e.g. Banking service, IT service, works-contract service, agents, intermediaries, GTAs etc. Note : Others will include Work Contract and Other Miscellaneous items. |

You can select only one core business activity.

In case all activities are applicable to you, kindly select your core business activity.

You should select your core business activity as - Manufacturer or Trader or Service Provider and Others based on highest turnover amongst them.

In case you want to change it in future you can do it by navigating MY PROFILE -> CORE BUSINESS ACTIVITY STATUS.