The Income Tax Department has notified the income tax returns for assessment year (AY) 2020-21 making it mandatory for assessees to file I-T returns for high-value transactions.

The high-value transactions include among others deposits in a current account worth over Rs 1 crore, electricity bill payment of Rs 1 lakh or more, and spending on foreign travel of Rs 2 lakh and above.

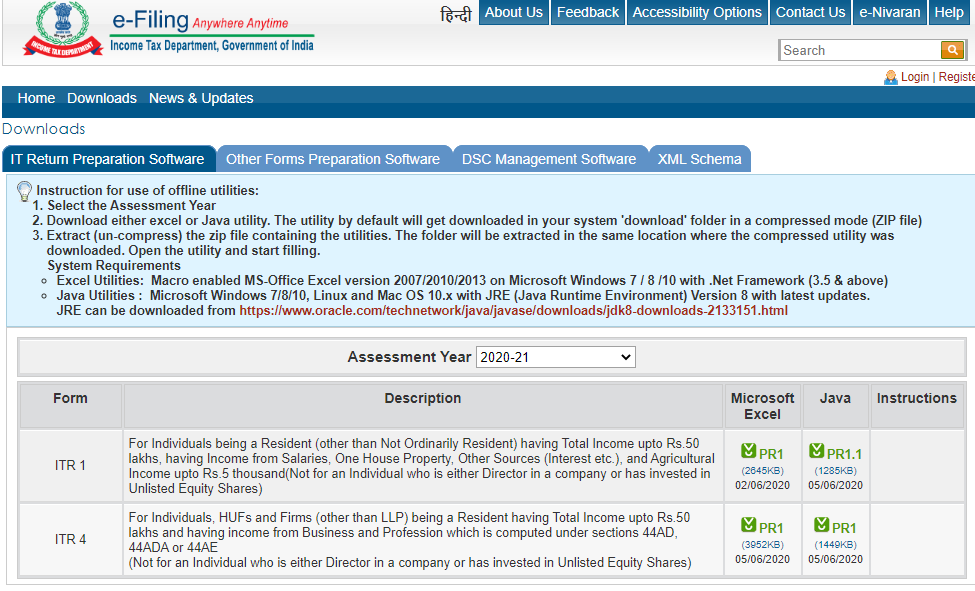

The department has also released the ITR-4 utility (e-form) on its e-filing website available in Excel and Java formats after releasing ITR-1 utility on June 02,2020.

Who can file ITR-4 for AY 2020-21?

ITR 4 Sugam form can be filed by the individuals / HUFs / partnership firm(other than LLP) being a resident if :-

It must be noted that the freelancers involved in the above-mentioned profession can also choose this scheme only if their gross receipts are not more than Rs 50 lakhs.

Changes in ITR forms for FY 2019-20 or AY 2020-21:

a) “Have you deposited an amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during the previous year?"

b) “Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person?"

c) “Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of electricity during the previous year?"

The new ITR forms seek details of all these investments and payments made in between April and June for claiming tax deduction.

Penalty for missing deadline

According to revised norms under the IT act an individual is liable to pay maximum of Rs 10,000 penalty after missing the deadline of ITR filing. While in case an individual total income does not exceed 5 lakhs then a penalty of only Rs 1,000 is applicable. The last date of filing ITR-4 for FY 2019-20 has been extended to November 30, 2020.

The tax department has also revised the I-T return forms to allow assessees to avail benefits of various timeline extensions granted by the government following the Covid-19 pandemic.