The Income Tax Department has notified the income tax returns for assessment year (AY) 2020-21 making it mandatory for assessees to file I-T returns for high-value transactions.

The high-value transactions include among others deposits in a current account worth over Rs 1 crore, electricity bill payment of Rs 1 lakh or more, and spending on foreign travel of Rs 2 lakh and above.

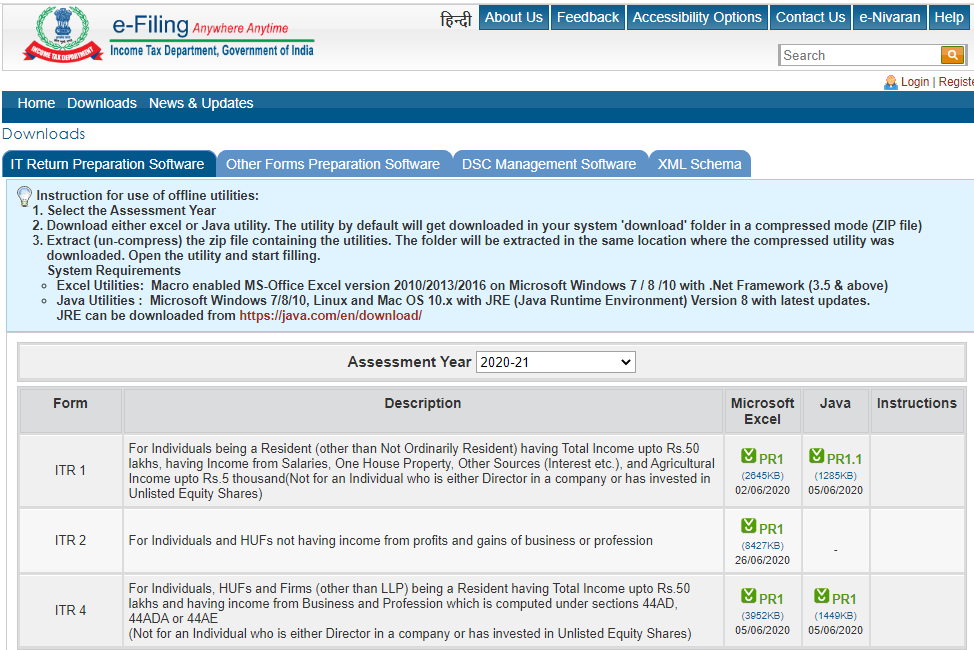

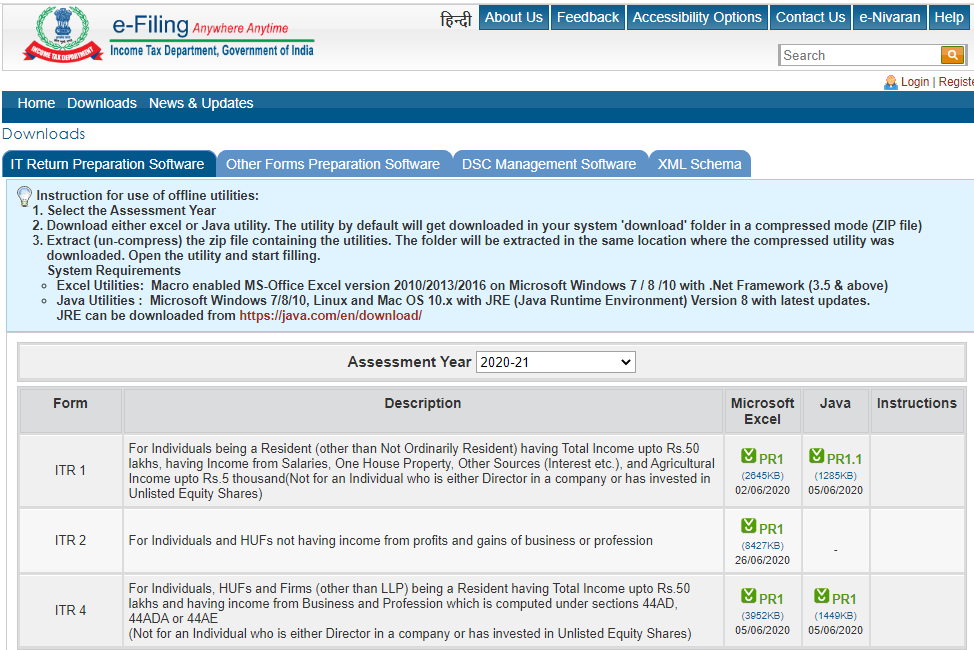

The department has also released the ITR-2 utility (e-form) on its e-filing website available in Excel and Java formats after releasing ITR-1 and ITR - 2 utility.

- Who can file ITR-2 for AY 2020-21?

ITR Form 2 is for Individuals and HUF receiving income other than income from “Profits and Gains from Business or Profession”. Thus persons having income from following sources are eligible to file Form ITR 2:

- Income from Salary/Pension

- Income from House Property(Income Can be from more than one house property)

- Income from Capital Gains/loss on sale of investments/property (Both Short Term and Long Term)

- Income from Other Sources (including winning from Lottery, bets on Race Horses and other legal means of gambling)

- Foreign Assets/Foreign Income

- Agricultural Income more than Rs 5000

- Resident not ordinarily resident and a Non-resident

- A Director of any company and an individual who is invested in unlisted equity shares of a company will be required to file their returns in ITR-2.

Changes in ITR forms for FY 2019-20 or AY 2020-21:

- Taxpayers need to answer the following questions related to deposits in current accounts, foreign travel and electricity bills in all the ITR forms:

a) “Have you deposited an amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during the previous year?"

b) “Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person?"

c) “Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of electricity during the previous year?"

- The income tax department has allowed taxpayers the laxity of making certain tax saving investments for FY 2019-20 till 30th June 2020 in view of the coronavirus lockdown. Deductions under Chapter-VIA-B of IT Act which includes Section 80C (LIC, PPF, NSC, etc), 80D (mediclaim) and 80G (donations) will now be allowed for spending till July 31st. The dates for making investment, construction or purchase for claiming roll over benefit in respect of capital gains under sections 54 to section 54GB has also been extended to July 31st.The new ITR forms seek details of all these investments and payments made in between April and June for claiming tax deduction.

- RNORs and non-resident individuals have to file their income tax return in ITR-2 even in case of total income below Rs 50 lakh.

- A separate schedule 112A for the calculation of the long-term capital gains on the sale of equity shares or units of a business trust which are liable to STT.