Today, we are going to discuss on steps to check outstanding demand against a particular TAN number.

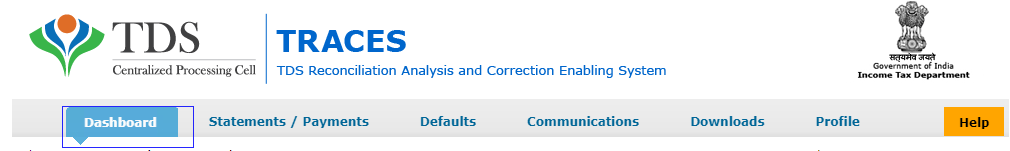

Step 1: Login on Traces website as deductor.

Step 2: Click on “Dashboard”.

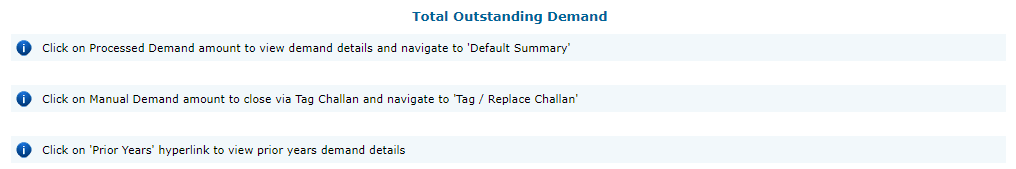

Step 3: After clicking on “Dashboard”. There is a tab of “Total Outstanding Demand”. (The same can be loacted at the Bottom Left Hand Side of the Screen.)

Step 4: Click on “Total Outstanding Demand” demand table will appear on the screen :

Step 5: User can view the “Default Summary” across quarters and form types in a financial year.

Step 6: User can click on particular quarter and can proceed with Online correction by clicking on the link “Request for Correction”.