The Central Board of Direct Taxes (CBDT) has very recently released JSON Utility for ITR-1 & ITR-4 for Assessment Year 21-22 and accordingly discontinued Excel and Java Version of ITR Utilities from AY 2021-22.

In this guide we will assist you to prepare ITR-1 and ITR-4 through JSON Utility.

Firstly, let us begin with the system requirements. So, for JSON utilities

- OS should be Windows 7 or later,

- Processor should be Intel Pentium 4 processor or later that's SSE2 capable or AMD K10 or above core architecture,

- RAM should be 1.5GB of RAM or more and

- HDD should be 500MB or more of free space

Here's the Step by Step Guide:

- Firstly, download the utility : Downloads -> Offline Utilities -> Income Tax Return Preparation Utilities or directly download from here.

- Now, extract the downloaded utility as a ZIP file.

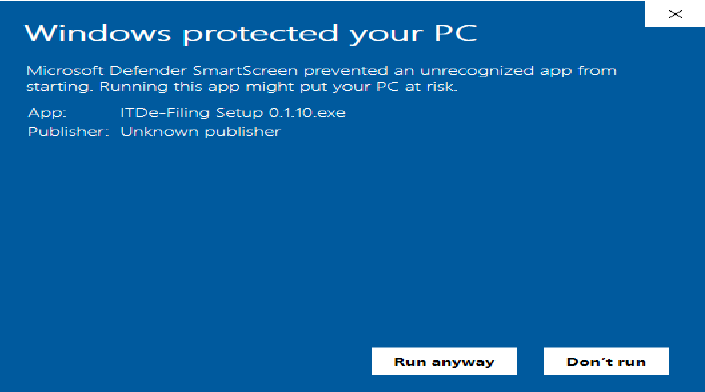

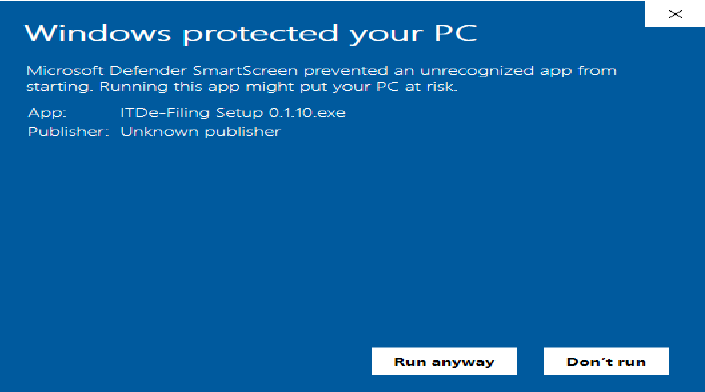

- In case, you receive this message, you click “Run Anyway” option in the dialogue box. (Refer image below)

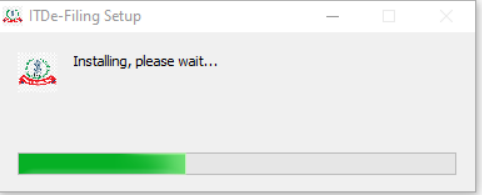

- Once you click on “Run Anyway”, your utility will start installing, after which you can proceed with filing your ITR. (Refer image below)

- As soon as you install the utility, you will be landed to Homepage. Click on “Continue” to fill your Incometax Return for AY 2021-22.

- Now, you will find 3 tabs: -

- Returns: - If you are filling the return for the first time, click on “File returns” in this tab.

- Draft version of returns: - If you have already started to file your return, you can see the draft version of your returns in this tab and click on “edit”.

- Pre-filled Data: - It will show you all pre-filled ITR data you had earlier imported into the utility.

- After that click on “File returns”, select the radio button to “Import pre-filled data”. On click of this option, the prefilled data already saved by you on your system in .json format can be imported to prefill the information in the income tax return.

- Enter the “PAN” for whom you want to fill the return and select the “Assessment year” and click on “Proceed”. Assessment Year 2021-22 can only be selected.

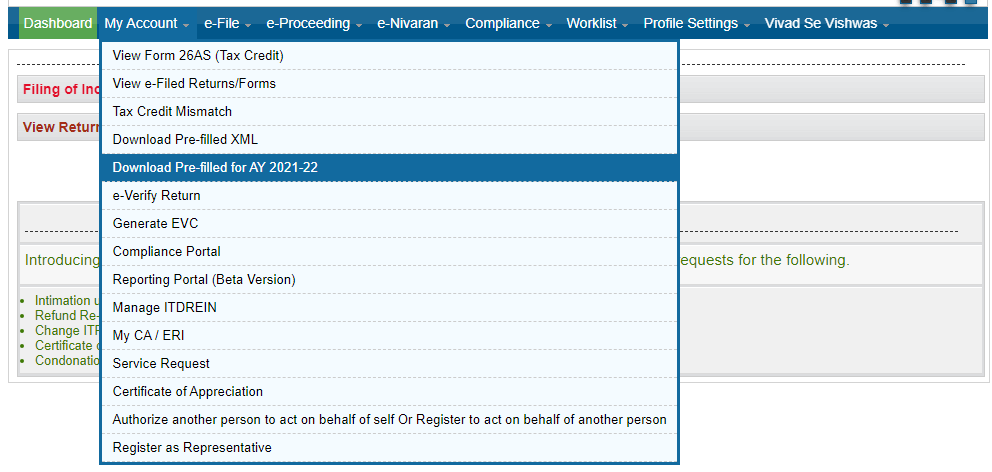

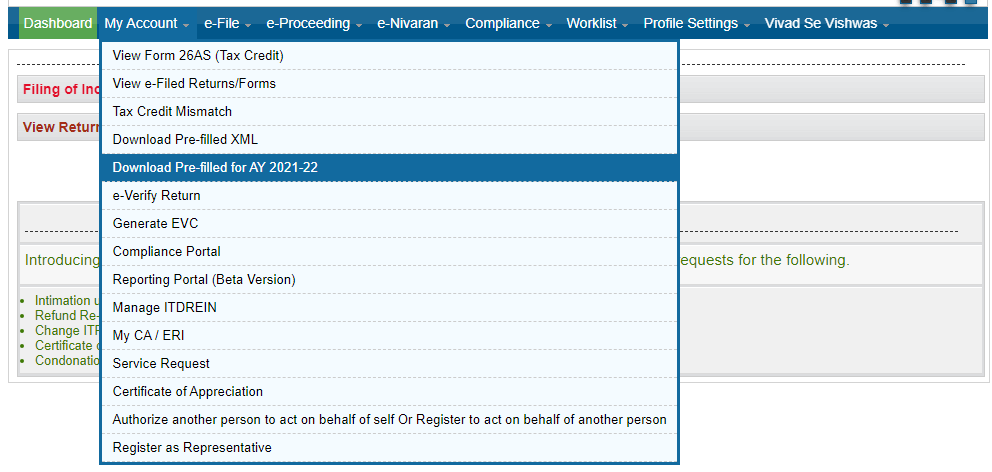

- Pre-filled json can be downloaded post login to the e-Filing portal from: 'My Account -> ‘Download Pre-Filled for AY 2021-22' and can be imported to the utility for prefilling the personal and other available details. (Refer image below)

- Attach the pre-filled JSON file from your system and click on “proceed”.

- On click of Proceed in earlier screen, you will be navigated to “Income Tax Returns” screen, where you can see the Basic pre-filled details from the imported JSON file. Click on “File Return” to continue.

- Select the Status (Individual | HUF | Others) applicable to you and click on “Continue”. Status will be pre-filled based on your last year’s data and will be editable.

- Select the ITR type which you want to file from the dropdown and “Proceed”. (A user-friendly questionnaire to identify ITR applicable to you will be available in subsequent release of the offline utility.)

- Click on “Let’s get started” to start filling your return.

- Fill the applicable and mandatory fields of the ITR form -> Validate all the tabs of the ITR form and Tax will be calculated.

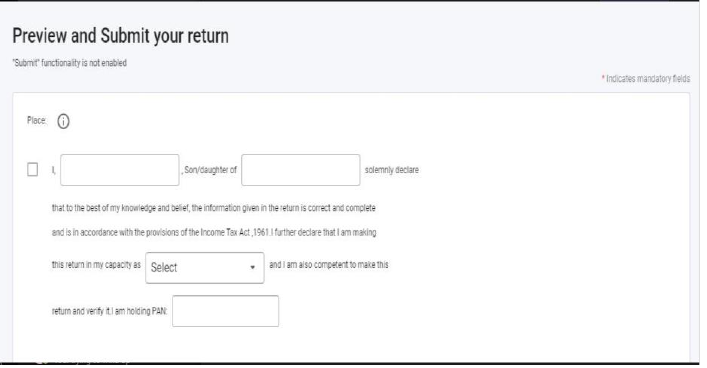

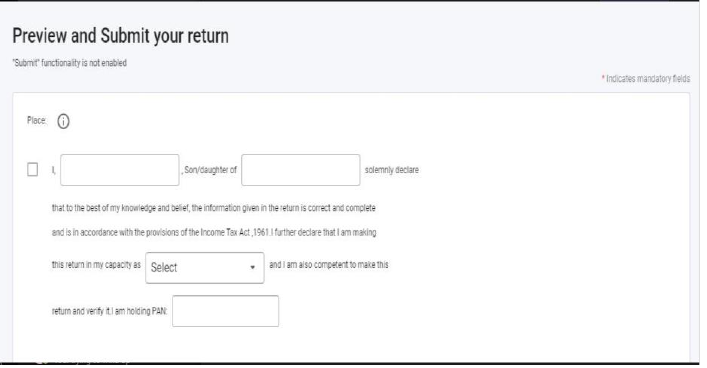

- After confirming all the schedules, you can Preview and submit your Return.

- You can either “Download” or “Print” the preview by clicking on the respective buttons. You can download the Preview on your system which will be downloaded in pdf format.

- Click on “Proceed to validation”, to validate the Return.

- All the errors needs to be validated by the user after that he can “Download JSON”.

- Simply click on the error, and you will be navigated to the field related to that error.

Important Points :

1) Import of Prefill JSON file is mandatory in utility.

2) Data will be refreshed on Real time basis.

3) Tax will be calculated on Real time basis.

4) Data will be Auto Saved.

5) The downloaded JSON file can be generated and saved on the system for uploading it on the efiling portal (post enablement of the functionality).

6) Facility to upload ITR at the e-filing portal is not enabled. You can fill and save it either within the utility or export output json file to your system.