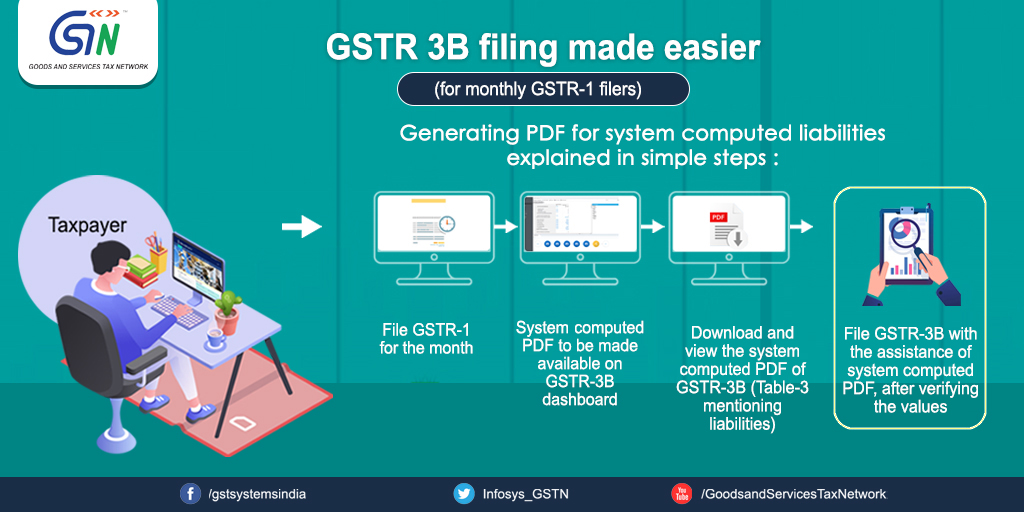

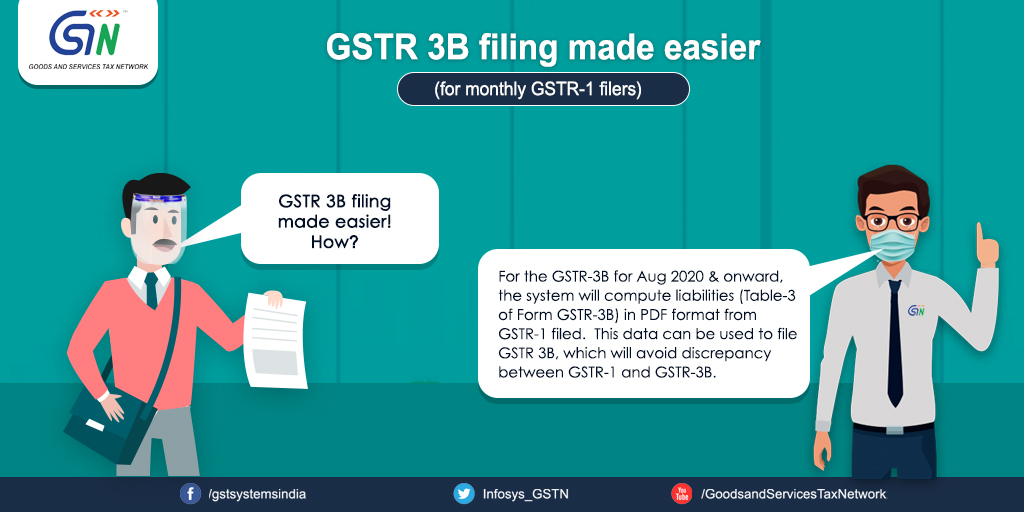

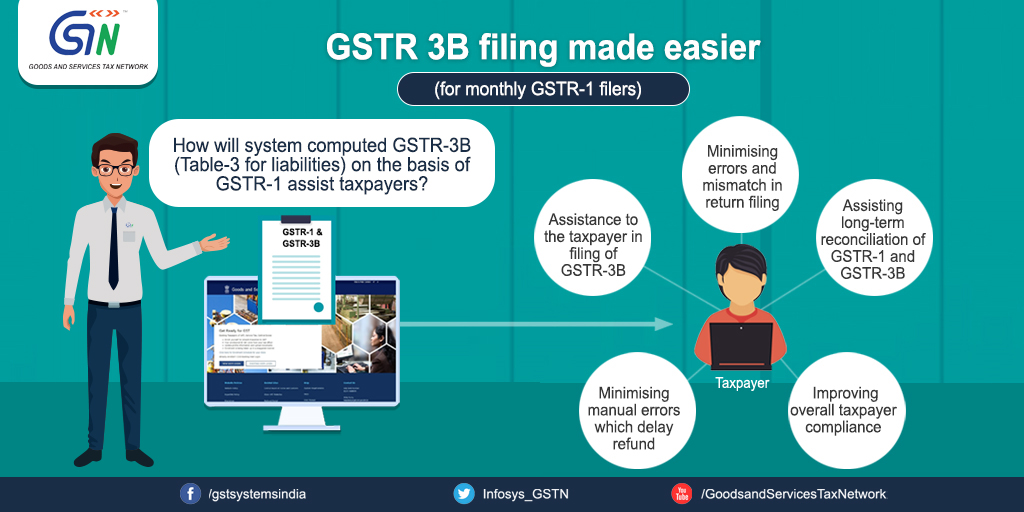

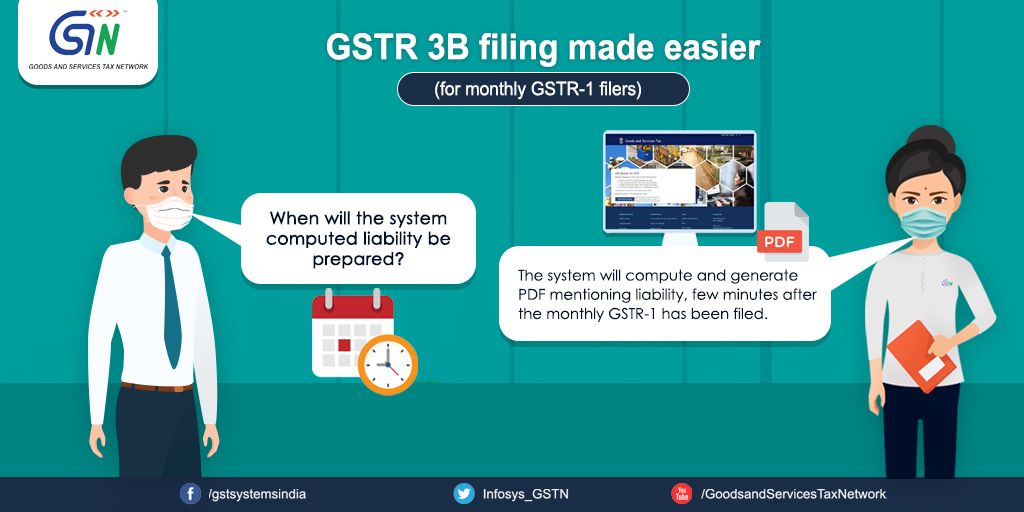

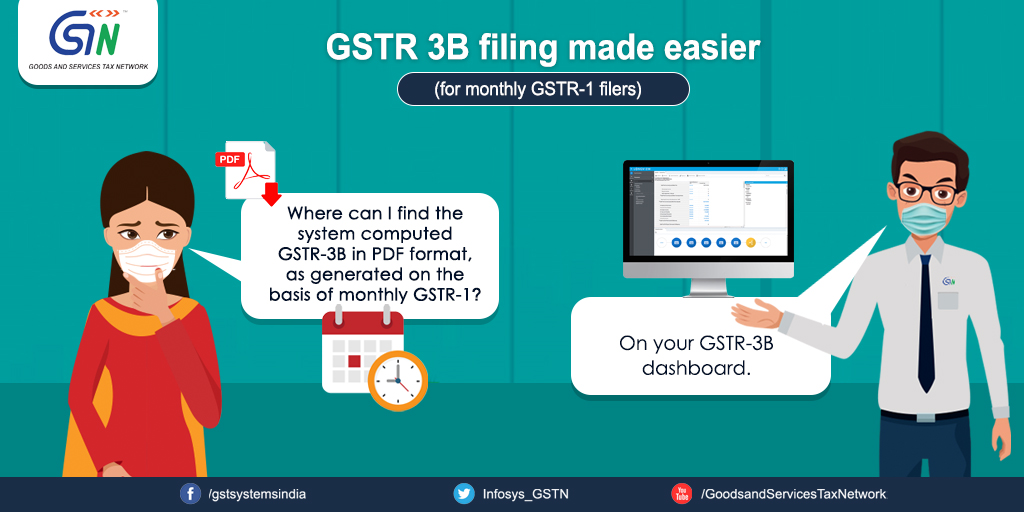

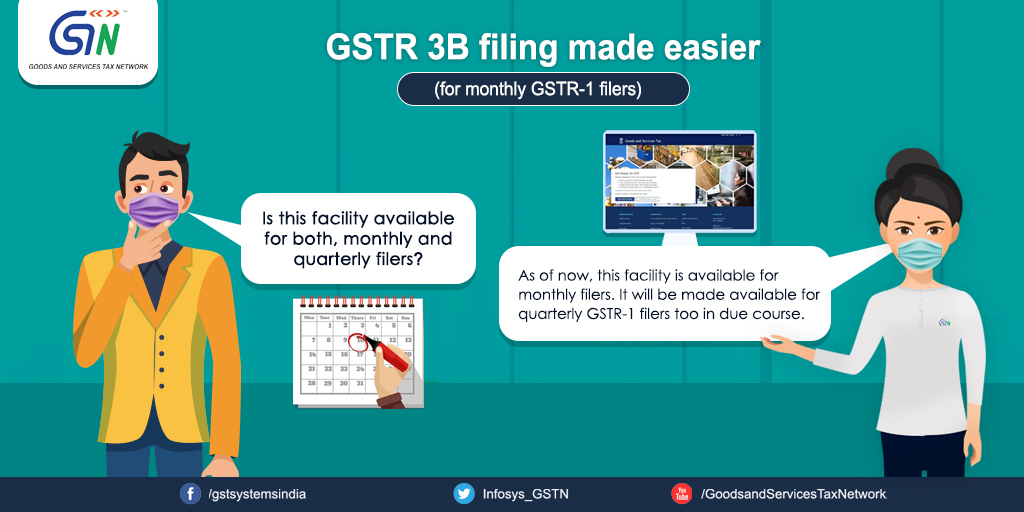

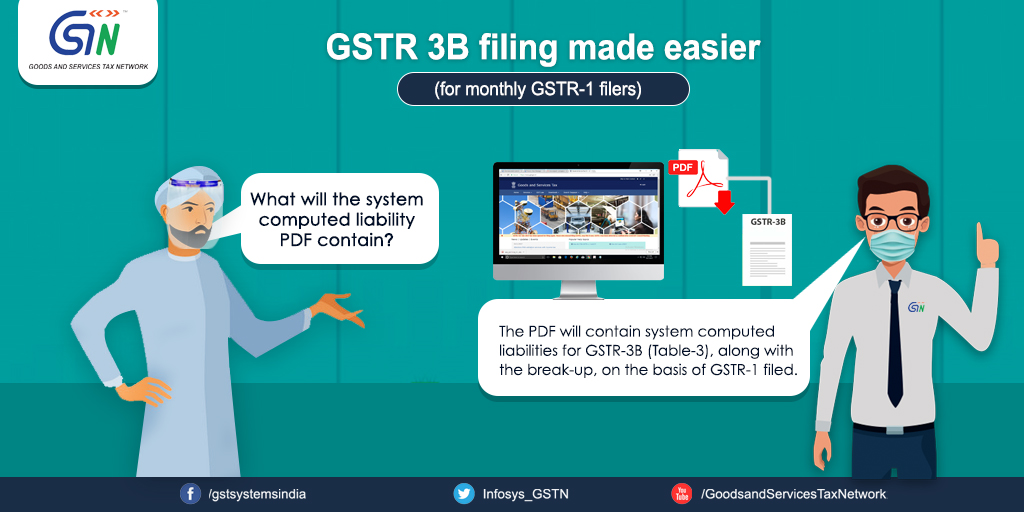

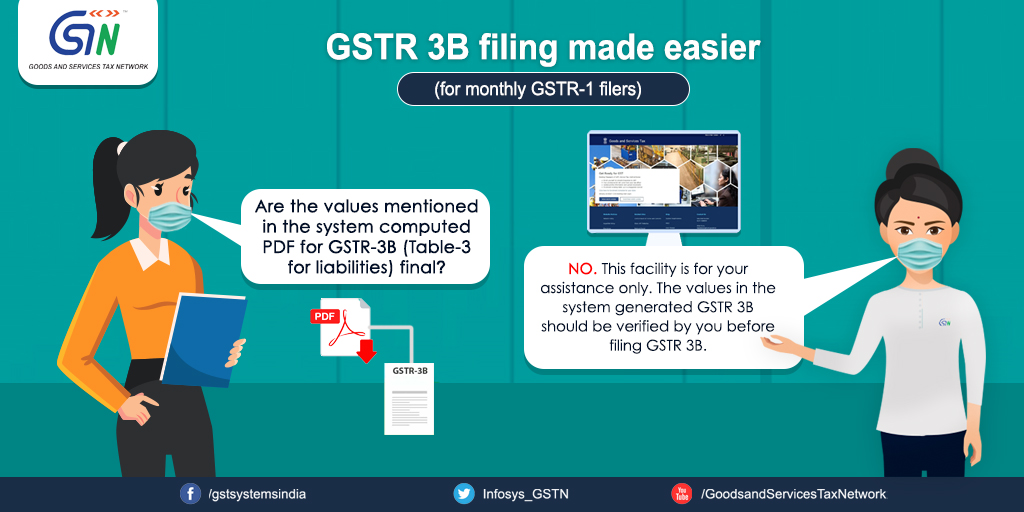

The Goods and Services Tax Network ( GSTN ) has enabled the System computed GSTR-3B (Table-3 for liabilities) on the basis of GSTR-1 filed by taxpayers now available on the GST portal for monthly GSTR-1 filers.

Comparing GSTR-3B with GSTR-1 is a much-needed process to be undertaken by every taxpayer in order to ensure that there are no variations or gaps, which could, in turn, lead to a demand notice from the tax authorities or unwanted issues that may arise and hinder the accurate filing of the annual returns.

Image Source: GST Tech

Image Source: GST Tech

Frequently asked Questions (FAQ's):

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech

Image Source: GST Tech