The Goods and Service Tax Network (GSTN) has enabled the option for opting for quarterly filing of GST returns under the quarterly return with the monthly payment (QRMP) scheme.

The GSTN announced that for the small taxpayers with annual aggregate turnover up to 5 Cr. will be made available on the common portal from 1st of January 2021.

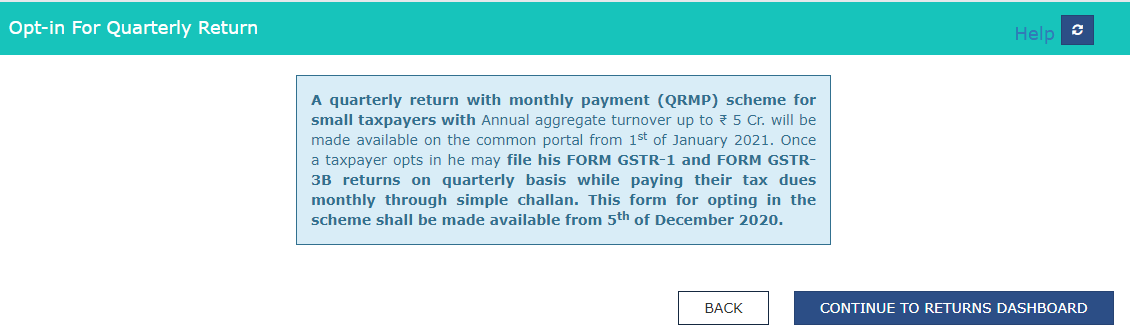

Once a taxpayer opts-in he may file his FORM GSTR-1 and FORM GSTR-3B returns on a quarterly basis while paying their tax dues monthly through simple challan. This form for opting in the scheme shall be made available from the 5th of December 2020. (This message is currently being shown on GSTN Portal.)