Form 26AS i.e. Annual Information Statement will now include monthly GST turnover based on the GSTR-3B for the relevant year.

CBDT vide Order dated 29/09/2020 had authorized regarding uploading Information relating to GST return in Form 26AS as per Rule 114-I.

The Central Board of Direct Taxes (CBDT) had authorised the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) to upload information relating to GST returns, which is in his possession, in the Annual Information Statement in Form 26AS, within three months from the end of the month in which the information is received by him.

The format of Form 26AS (26AIS) was also modified and enlarged to include information received from other departments/ agencies, including the GST authorities.

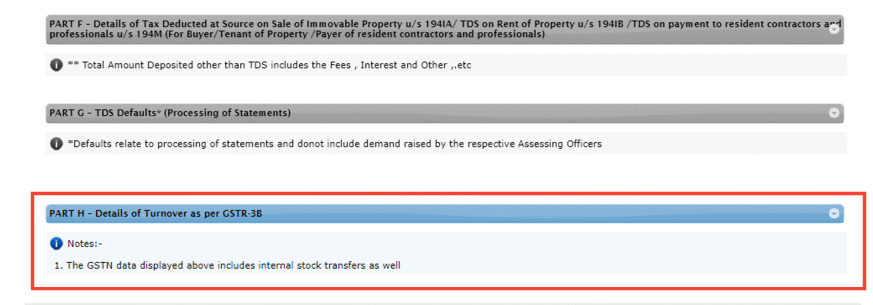

As shown in above image Part H of Form 26AS shall now show details of turnover as per GSTR-3B.

The table under Part H includes

The table also mentions that this will include internal stock transfer as well.

Steps to View/Download Form-26AS by e-Filing Portal: