In a significant move towards taxpayer facilitation, the Government has today onwards allowed filing of NIL GST monthly return in FORM GSTR-3B through SMS. This would substantially improve ease of GST compliance for over 22 lakh registered taxpayers who had to otherwise log into their account on the common portal and then file their returns every month. Now, these taxpayers with NIL liability need not log on to the GST Portal and may file their NIL returns through a SMS.

For this purpose, the functionality of filing Nil FORM GSTR-3B through SMS has been made available on the GSTN portal with immediate effect. The status of the returns so filed can be tracked on the GST Portal by logging in to GSTIN account and navigating to Services>Returns>Track Return Status. The procedure to file Nil returns by SMS is as follows: -

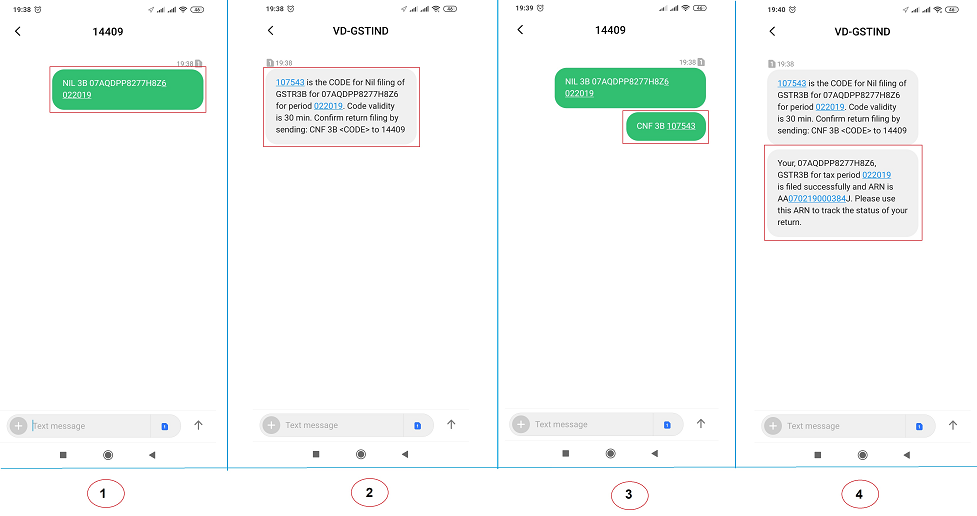

To file Nil Form GSTR-3B through SMS, follow the below mentioned steps. Let's take an example that you need to file Nil Form GSTR-3B through SMS for a GSTIN 33AACCA1121EAZE for tax period (monthly filer) February 2020 :

|

S.No. |

Step-List |

Example |

| 1. |

Send SMS to 14409 number to file Nil Form GSTR-3B. |

NIL 3B GST No. |

| 2. |

After receiving the SMS, GST Portal will check for the validations. Note: If validations for filing Nil Form GSTR-3B are satisfied, you will receive a “Verification CODE” on the same mobile number from which you have sent the SMS to complete the filing. If validations for Nil filing are not satisfied, you will receive appropriate response/ error message to the same mobile number from which you have sent the SMS. Note: Verification Code is usable only once and will expire within 30 minutes. Please do not share this with anyone. |

|

| 3. |

Send SMS again on the same number 14409 with Verification Code (For Example: Verification Code received here is 107543) to confirm filing of Nil Form GSTR-3B. Note: Taxpayers are required to compose a new text message to 14409. |

CNF 3B 107543 |

| 4 |

After successful validation of “Verification Code", GST Portal will send back ARN to same mobile number and on registered e-mail ID of the taxpayer to intimate successful Nil filing of Form GSTR-3B . |

|