Ind AS 10 "Events after the Reporting Period" is applied in the accounting for, and disclosure of, events after the reporting period.

What are the objectives of implementing this Ind AS?

Now, let us start decoding Ind AS 10:

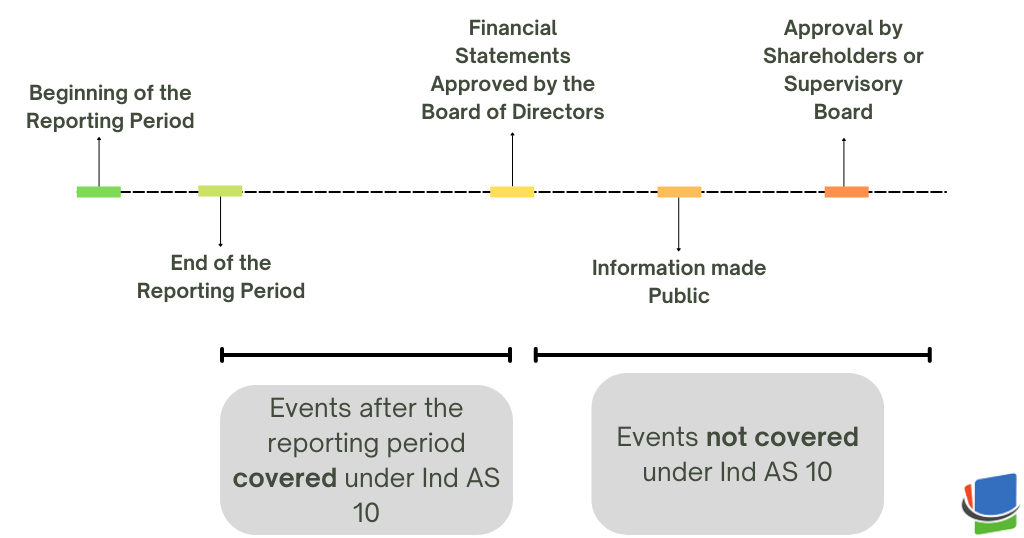

Events occuring after the reporting period : These are favourable as well as unfavourable events that occur between the end of the reporting period & date when the financial statements are approved (board of directors in case of company).

It may be pertinent to note that despite the requirement for approval of financial statements by Shareholders or Supervisory Board (made up solely of non-executives), for the purposes of deciding events occuring after reporting period , the date of approval by board of directors will be considered as date of approval.

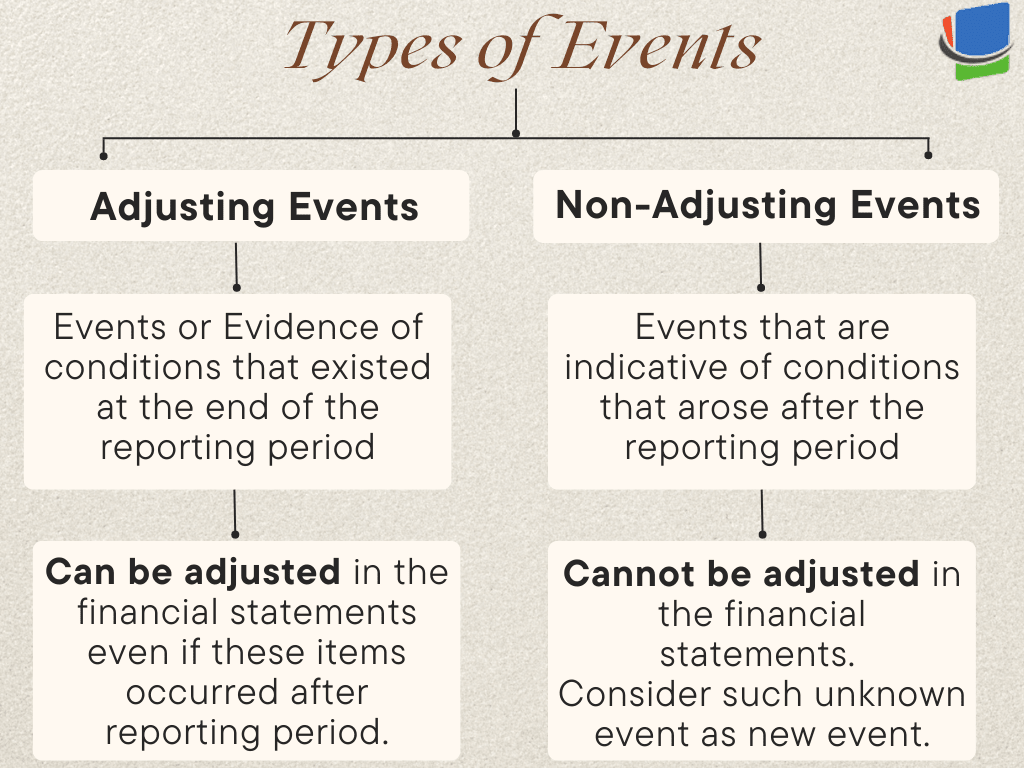

Types of Events :

Some Examples of Adjusting Events :

Some Examples of Non-Adjusting Events :

However, If non-adjusting events after the reporting period are material, non-disclosure could influence the economic decisions that users make on the basis of the financial statements.

Examples : Announcing a plan to Discontinue an Operation, Destruction of a Major Production Plant by a Fire, etc.

Accordingly, an entity shall disclose the following for each material category of non-adjusting event after the reporting period:

(a) the nature of the event; and

(b) an estimate of its financial effect, or a statement that such an estimate cannot be made.

Dividends : If an entity declares dividend between the end of reporting period and date of approval of financial statements, then it will not be recognised as a liability because no obligation to pay dividend exists at the end of reporting period. However, such dividends are disclosed in the notes in accordance with Ind AS 1.

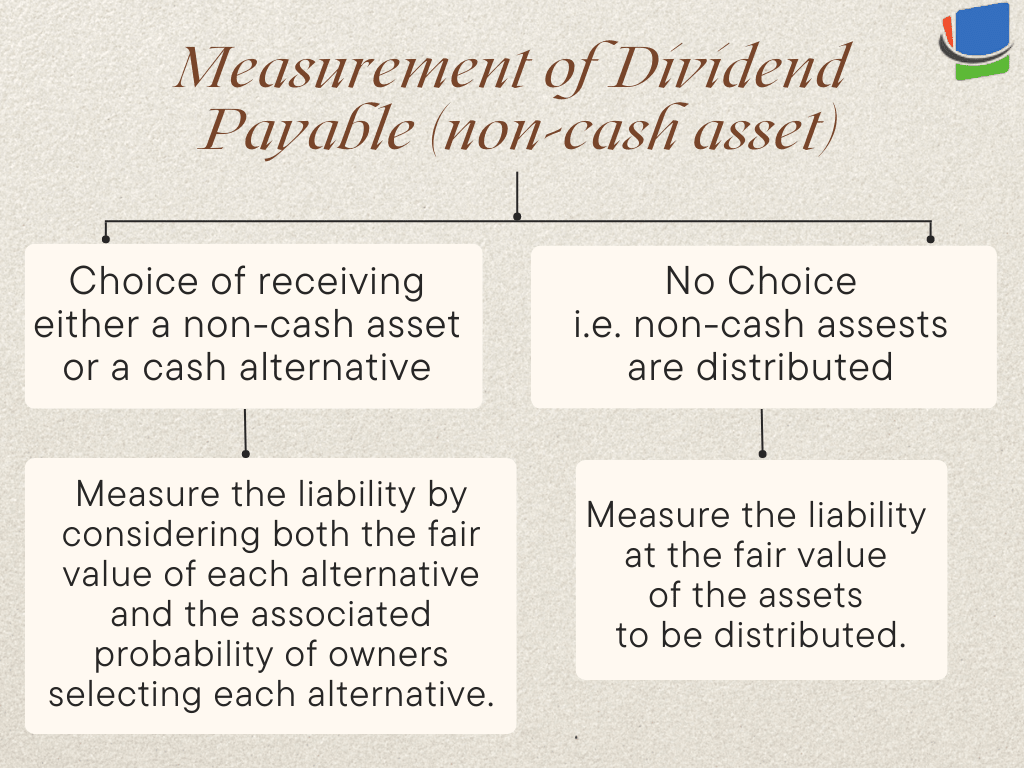

If an entity declares dividend, it must recognise a liability for the dividend payable. Now, if entity wishes to declare dividend in the form of non-cash asset a question might arise as to how to measure dividend payable?

At the end of each reporting period and at the date of settlement, the entity shall review and adjust the carrying amount of the dividend payable, with any changes in the carrying amount of the dividend payable recognised in equity as adjustments to the amount of the distribution.

At the the time of settlement, the difference between the carrying amount of the assets distributed and the carrying amount of the dividend payable should be recognised in profit or loss.

Going Concern : If after the reporting period but before the approval of financial statements, there are signs or intentions which affects going concern assumption, then the entity should not prepare its financial statements on going concern basis.

Example : Deterioration in operating results and financial position after the reporting period, Occurence of Major Incident, etc.