The CBIC has issued clarification to deal with difference in Input Tax Credit (ITC) availed in GSTR-3B and GSTR-2A for FY 2017-18 and 2018-19 vide Circular No. 183/15/2022-GST dated 27/12/2022.

During the early stages of GST implementation, many suppliers have provided incorrect information about their outward supplies in their FORM GSTR-1, leading to discrepancies in the GSTR-2A of their recipients. However, these recipients may have claimed input tax credit for these supplies in their GSTR-3B returns. As a result, tax officers have identified differences between the input tax credit claimed by registered persons in their GSTR-3B returns and the amount recorded in their GSTR-2A during inspections, audits, and investigations. These discrepancies are being considered to be instances of registered persons claiming ineligible input tax credit and are being flagged for seeking explanation for such discrepancies and/or for reversal of such ineligible ITC.

Scenarios due to which the supplies made are not reflected in GSTR-2A of the recipients and which are dealt by this circular:

Verfication process to be carried by Proper Officer:

If supplier had declared the supply with wrong GSTIN of the recipient in GSTR-1, then, Proper Officer of the actual recipient will also intimate the concerned jurisdictional tax authority of the registered person, whose GSTIN has been mentioned wrongly, that ITC on those transactions is required to be disallowed, if claimed by such recipients in their FORM GSTR-3B.

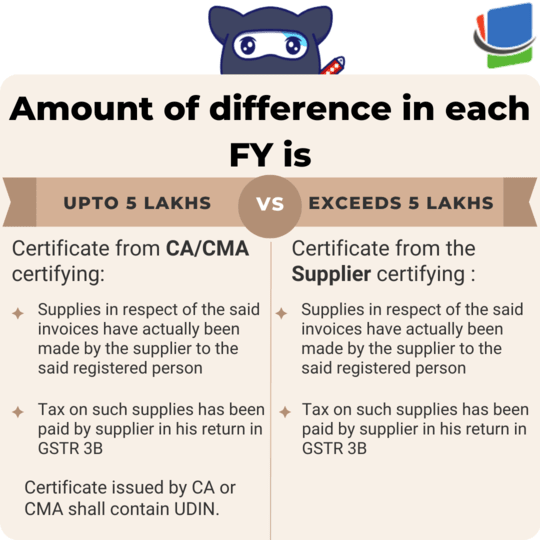

Certificate required to verify conditions prescribed under section 16(2)(c) of CGST Act :

Important Points :

- The aforesaid benefit (for the period FY 2017-18) shall not be available if the supplier has furnished such supply in GSTR-1 after the due date for the month of March, 2019.

- These instructions will apply only to the ongoing proceedings in scrutiny/audit/ investigation, etc. for FY 2017-18 and 2018-19 and not to the completed proceedings.

- However, these instructions will apply in those cases for FY 2017-18 and 2018-19 where any adjudication or appeal proceedings are still pending.