The Finance Minister presented the Finance Bill 2023 on February 1, 2023, proposing amendments to make the new 115BAC personal tax regime more appealing.

In the old tax regime, there are deductions for certain investments (e.g. EPF, PPF) under section 80C and medical insurance under 80D, as well as standard deductions and HRA benefits for salaried individuals.

However, the new tax regime (prior to the Budget 2023) does not allow for these deductions and all income is taxed. The mandatory forfeiture of deductions for those opting for the new regime under 115BAC introduced by the Finance Act 2020 has made it less popular.

To address this, the FM has proposed to increase the rebate under section 87A to Rs. 25,000 (from Rs. 12,500), making it more attractive for those earning up to Rs. 7 lakhs, who can now pay zero taxes without having to make investments or purchase insurance to save on taxes.

This has caused confusion for many trying to determine which regime is better for their income situation.

So, let's begin decoding which tax regime is better for you:

| Total Income | Old Tax Regime |

New Tax Regime (F.Y. 2023-24) |

| Upto Rs. 2,50,000 | 0% | 0% |

| Rs. 2,50,001 to Rs. 3,00,000 | 5% | 0% |

| Rs. 3,00,001 to Rs. 5,00,000 | 5% | 5% |

| Rs. 5,00,001 to Rs. 6,00,000 | 20% | 5% |

| Rs. 6,00,001 to Rs. 9,00,000 | 20% | 10% |

| Rs. 9,00,001 to Rs. 10,00,000 | 20% | 15% |

| Rs. 10,00,001 to Rs. 12,00,000 | 30% | 15% |

| Rs. 12,00,001 to Rs. 15,00,000 | 30% | 20% |

| Rs. 15,00,001 and above | 30% | 30% |

Now, let's move toward examining the tax liability under both regimes post budget 2023 at various levels of income:

Case A : Income from Salary with only Standard deduction

(Calculations are made for individuals under 60 years of age. The "New Regime" refers to the updated tax regime after the 2023 Budget. Tax is excluding Cess.)

Case B : Income from Salary with Standard deduction and 80C

(Calculations are made for individuals under 60 years of age. The "New Regime" refers to the updated tax regime after the 2023 Budget. Tax is excluding Cess.)

Case C : Income from Salary with Standard deduction, 80C and 80D

(Calculations are made for individuals under 60 years of age. The "New Regime" refers to the updated tax regime after the 2023 Budget. An 80D deduction of 50,000 rupees consists of 25,000 rupees for the self/spouse and 25,000 rupees for the parents. Tax is excluding Cess.)

Case D : Income from Salary with Standard deduction, 80C, 80D and Interest on Housing Loan - Section 24(b)

(Calculations are made for individuals under 60 years of age. The "New Regime" refers to the updated tax regime after the 2023 Budget. An 80D deduction of 50,000 rupees consists of 25,000 rupees for the self/spouse and 25,000 rupees for the parents. Tax is excluding Cess.)

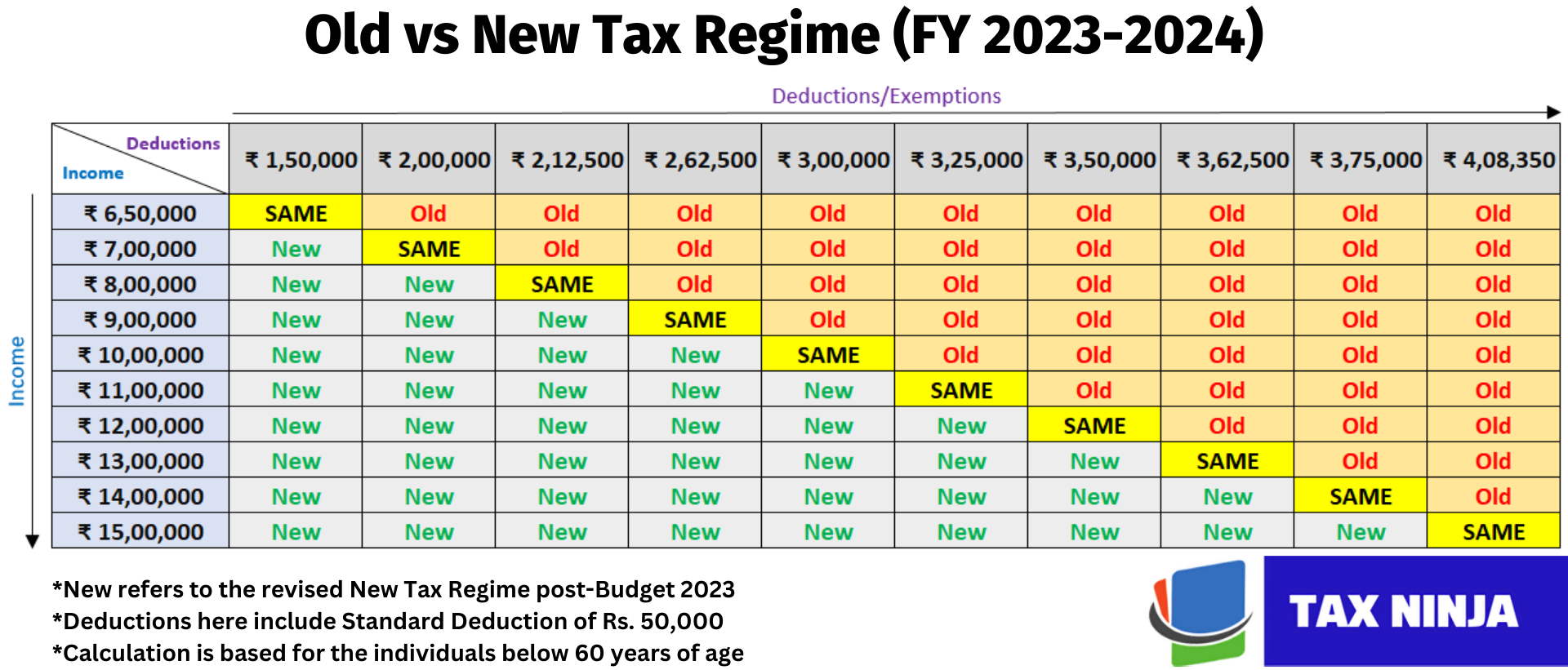

Okay, we understand. You may still be confused. So, here's Break-Even Point Analysis between New and Old Personal Tax Regime.