The Finance Bill 2023, presented by the Honorable Minister of Finance on February 1, 2023, proposes a special amendment to Section 43B of the Income Tax Act, 1961, aimed at making it more favorable for Micro, Small, and Medium Enterprises (MSMEs) to get the payments in the earliest possible time.

Let's examine the proposed amedment step by step to gain a better understanding of the reasoning behind the proposed amendment:

Promoting timely payments to Micro and Small Enterprises

1. Section 43B of the Act provides for certain deductions to be allowed only on actual payment. Further, the proviso of this section allows deduction on accrual basis, if the amount is paid by due date of furnishing of the return of income.

2. In order to promote timely payments to micro and small enterprises, it is proposed to include payments made to such enterprises within the ambit of section 43B of the Act. Accordingly, it is proposed to insert a new clause (h) in section 43B of the Act to provide that any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development (MSMED) Act 2006 shall be allowed as deduction only on actual payment. However, it is also proposed that the proviso to section 43B of the Act shall not apply to such payments.

3. Section 15 of the MSMED Act mandates payments to micro and small enterprises within the time as per the written agreement, which cannot be more than 45 days. If there is no such written agreement, the section mandates that the payment shall be made within 15 days. Thus, the proposed amendment to section 43B of the Act will allow the payment as deduction only on payment basis. It can be allowed on accrual basis only if the payment is within the time mandated under section 15 of the MSMED Act.

4. This amendment will take effect from 1st April 2024 and will accordingly apply to the assessment year 2024-25 and subsequent assessment years.

Lets decode the amendment and understand it point by point:

1) Understanding what is section 43B of the Income tax Act, 1961 (Reference: Para 1 of aforementioned text)

Section 43B of the Income tax Act, 1961, specifies that companies can only claim certain expenses as deductions in the same previous year in which they were paid and not when they accrued. These expenses are outlined in Clauses (a) to (g) below:

(a) Any tax, duty, cess, or fee paid under any applicable law, including GST, customs duty, or other taxes or cesses, and the interest paid on these taxes.

(b) Contributions made by an employer to a recognized employee benefit fund, such as a Provident Fund, superannuation fund, or gratuity fund, before the due date for depositing the funds or before the due date for filing income tax returns.

(c) Actual bonus or commission paid to employees, not dividends paid to them as shareholders.

(d) Interest on borrowings from Public Financial Institutions or State Financial Corporations, subject to the conditions of the loan.

(e) Interest on loans and advances from Scheduled Banks, subject to the conditions of the loan.

(f) Leave encashment provided by an employer to employees.

(g) Payments made to the Indian Railways.

Additionally, there is a provision in this section that allows for the deduction of the aforementioned expenses on an accrual basis, provided they are paid before the due date for filing the return u/s 139.

Although there are certain conditions regarding the applicability of this proviso, they are irrelevant to discuss here as the new amendment has an overriding effect on the proviso.

2) There are two key points to consider while reaching the wise interpretation of the amendment. (Reference: Para 2 & 3 of aforementioned text)

(A) Section 15 of the Micro, Small and Medium Enterprises Development (MSMED) Act 2006, and

(B) The timing for claiming expenses on an accrual basis.

So, what does the text of Section 15 of the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006 state?

It says, "Where any supplier, supplies any goods or renders any services to any buyer, the buyer shall make payment therefore on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance."

Interpretation: In the case of contracts with MSMEs, the payment has to be made within the time period as per the agreement, where the period shall not exceed 45 days.

So, in simpler terms, the payment must be made either within the agreed period or 45 days, whichever is earlier.

Q When can expenses be claimed on an accrual basis?

A Clause (h) overrides the proviso to Section 43B, meaning that even if a payment is made before the due date for filing the income tax return, the expense will not be allowed in the year it was accrued. Instead, it will only be allowed in the year it is actually paid.

Q Is it that simple? Can expenses be allowed in the previous year if they are paid before the year-end?

A No, it's not that simple. The Finance Act 2023 also proposes to insert a new Clause (h) in Section 43B to provide that any sum payable by the assessee to a Micro or Small Enterprise that exceeds the time limit specified in Section 15 of the MSMED Act 2006 shall only be allowed as a deduction upon actual payment. This means that if payment is made after the time limit specified in the MSMED Act, the expense will only be allowed as a deduction in the year it is actually paid.

Let's take a deeper dive into some cases to gain a better understanding :

Case 1 : Payment made within the agreed time and as per section 15 of MSMED act.

So now as per amendment, the criterias will be evaluated as follows:

Therefore, the expense will be allowed in the previous year 2023-24 and will not be disallowed under clause 'h' of section 43B.

Case 2 : Payment made within the agreed time but not as per section 15 of MSMED act.

So now as per amendment, the criterias will be evaluated as follows:

Therefore, the expense will not be allowed in the previous year 2023-24 as it will be disallowed under clause 'h' of section 43B. It will instead be considered allowable in the year of payment i.e., previous year 2024-25.

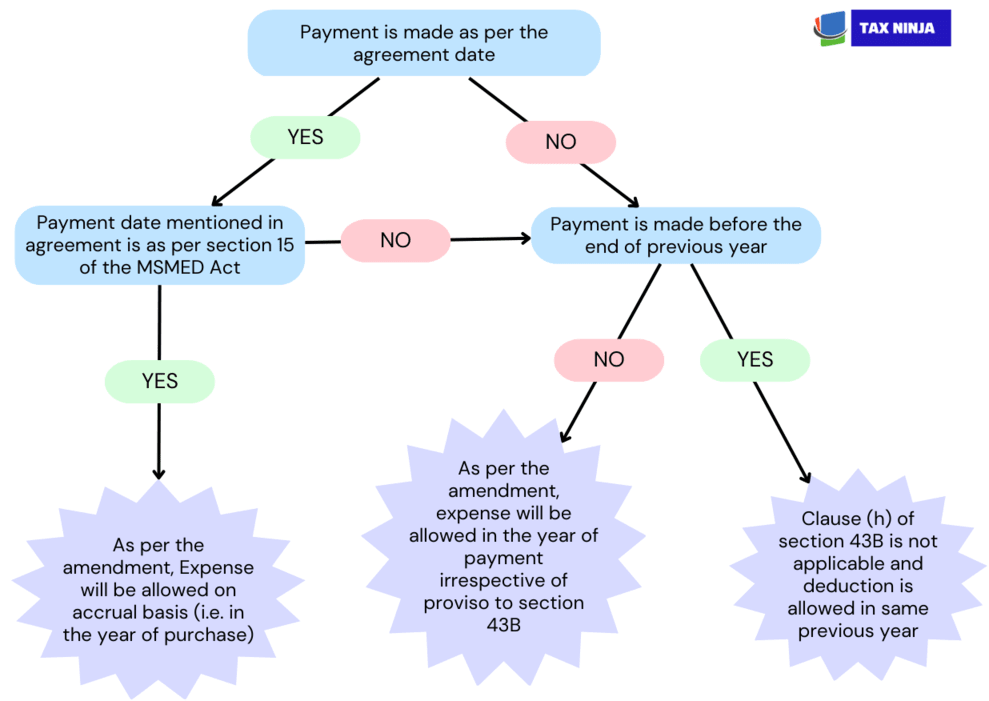

To make it easier to understand the entire article, I have prepared a decision tree chart that clearly illustrates all the cases, no matter how complex they may seem.