Union Minister of Finance Nirmala Sitharaman released the Union budget for 2023 yesterday, in which she proposed to extend the benefit of the standard deduction to the new tax regime.

She stated, "Each salaried person with an income of Rs. 15.5 lakh or more will stand to benefit by Rs. 52,500."

This statement, however, has created a lot of confusion surrounding the standard deduction.

To clear up any misunderstandings, let's take a closer look and clarify any doubts that you may have :

QIs the standard deduction under the new tax regime Rs. 52,500 or Rs. 50,000?

AThe standard deduction for salaried individuals and pensioners under the new tax regime is Rs. 50,000.

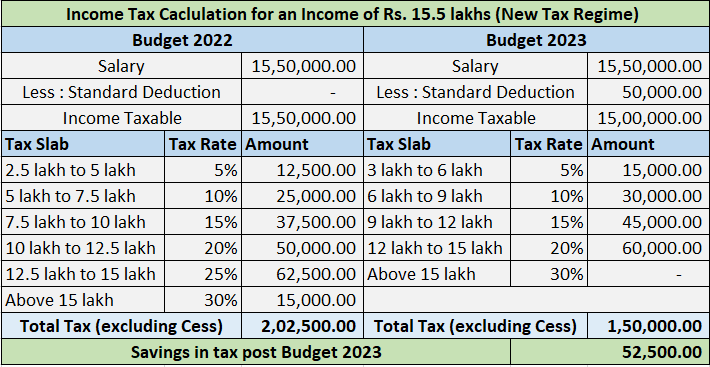

Now, in order to understand FM's statement, let's take a closer look at Income Tax Caclulation for an Income of Rs. 15.5 lakhs :

Thus, you can see that there is a tax savings of Rs. 52,500 after the introduction of the standard deduction of Rs. 50,000 in the 2023 Budget, compared to the 2022 Budget.

QIs this deduction only available for salaried individuals with an income more than Rs. 15.5 lakhs?

ANo! The benefit of Standard Deduction of Rs. 50,000 has been extended to All Salaried Individuals under the New Tax Regime.

Stay tuned for a deep dive into the direct and indirect tax proposals!